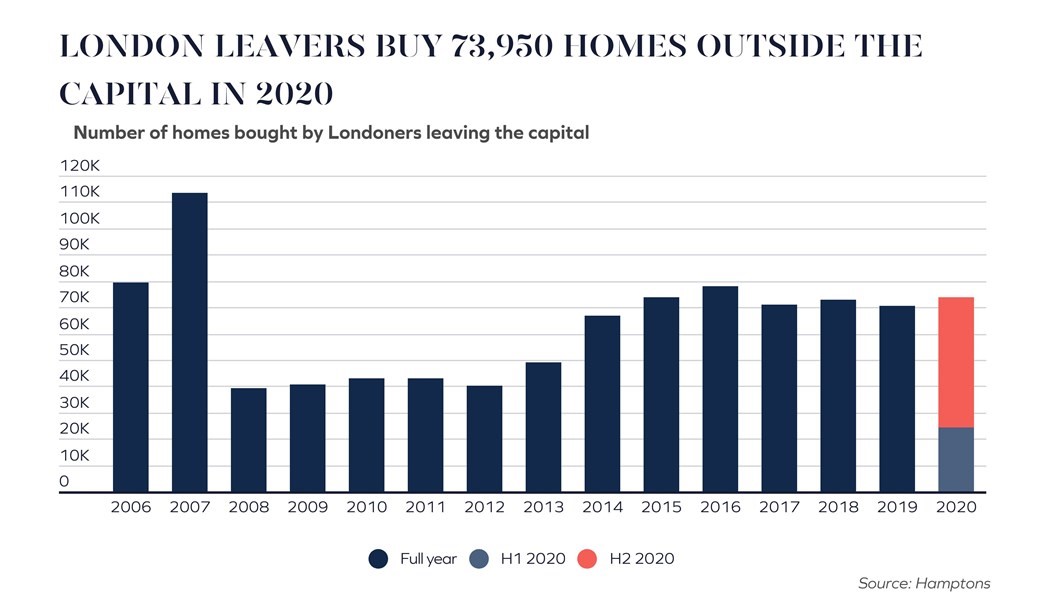

Did you know that almost 74,000 Londoners purchased homes outside the capital in 2020 as they sought a move away?

It is proof, some would say, that the city has lost its appeal. Or, more specifically, that there is a mass migration of homebuyers and property investors away from London and towards more rural areas––a trend that has come about as a result of the pandemic.

Indeed, this has been a regular subject for debate within the property market over the past 18 months.

As some commentators have tended to extrapolate short-term trends and suggest they are indicative of a “new normal”, they have in turn argued that urban living will no longer remain as commonplace as it once was.

The rise of remote working and the desire for more space, both within a property and surrounding it, are purportedly here to stay.

So, surely, people will no longer want to live in central London?

For me, this stance is problematic at best.

The truth behind the numbers

The statistic noted above comes from the estate agent Hamptons; its data shows that London leavers did in fact purchase 73,950 homes outside the capital last year.

However, while there have been many headlines focusing on such figures, they do not always show that this number is largely in keeping with the annual averages of the past decade, as can be clearly seen in this table.

There has been a propensity in some quarters of the property market to create a narrative wherein people are only leaving London––it is a one-way direction of travel, and the city is slowly emptying. But this is inaccurate.

There has always been a constant flow of people both leaving and moving to London in large numbers. For example, between 2009 and 2019, it is estimated that about 550,000 more Britons left London than moved to it.

However, crucially, the population grew in this period thanks to both the higher birth rate within the Greater London area, and net migration to the city.

It is, of course, part of life that people leave the place in which they live. They might trade urban living for the countryside, or they might simply move to another town or city.

It might be motivated by quality of life, the properties they can afford, career opportunities or family reasons. But the simple fact is that people still gravitate towards London.

London’s lasting appeal

There are various reasons why London still appeals as a place to live, work and invest in property.

Indeed, in a recent interview, Tom Walker, a Schroders fund manager specialising in global cities, commented:

“The media is focussing on the people who are moving “away” from the city and not on those who are moving to the city, especially younger people.”

“So far, the data is telling us that those that are moving away are not moving very far, only to the suburbs.”

“People understand that they cannot be too far from the city, both from a professional and personal point of view.”

London is home to more than 1.1 million private businesses. It has a high concentration of world-leading hospitals and universities (four in the top 50). It recently recovered its place as Europe’s leading trading hub, while the latest Global Financial Centres Index ranked the city as the second-best financial centre in the world, behind New York.

Add to this its transparent legal system and strong tradition of rule of law. Then, of course, there are the thousands of cultural sites and activities, as well as the hospitality and leisure venues on offer, which are slowly reopening and resuming more normal service.

These fundamental factors, developed over centuries, are what have attracted people to London, not just from within the UK but around the globe.

The pandemic has tipped life upside down in the short-term, but predictions that London has lost its appeal and will no longer be an epicentre for commerce, culture and investment seem to disregard all the city still has to offer that cannot be found elsewhere.

Property investment in London

London’s lasting appeal is underlined by the strength of the prime central London (PCL) property market.

Research by Astons recently highlighted that London remains one of the world’s leading prime real estate markets.

The real estate investment firm has predicted that, based on a property sized at 43 square metres, global prime real estate values will increase by 1.8% in 2021.

It also said that only three global markets are expected to see value of the average prime property remain above £1 million: London, Monaco and Hong Kong.

Meanwhile, figures from Benham and Reeves have found that buyer interest in London’s £2 million-and-above properties have risen throughout 2021.

All of this data, while not groundbreaking, points towards the stability of the PCL market, rather than suggesting that buyers and renters are flocking away from the capital.

For me, it illustrates that there has been too much focus on short-term trends during the pandemic, most of which have been shaped by unique circumstances and heavy levels of state involvement.

Once the threat of Covid-19 subsides and there is less interest in predicting what the so-called ‘new normal’ will look like, there will be greater appreciation for what remains the same.

London’s position as a jewel in the UK’s crown and global hotspot for property investment is a prime example.

Author: Alpa Bhakta is the CEO of Butterfield Mortgages Limited. Part of Butterfield and a subsidiary of The Bank of N.T. Butterfield & Son Limited. Butterfield Mortgages Limited is a London-based prime property mortgage provider with a particular focus on the needs of UK and international HNWIs.

Comments