New figures today from Foxtons, London’s leading lettings agent, show that, compared with January 2022, which was an outlier, demand fell slightly by 4%.

However, compared with the more traditional pre-pandemic rental landscape, such as that seen in January 2020, demand was up 77%.

South London continued to be the most popular among renters, with the highest rental registrations by value compared to other London regions, while West London saw the highest year on year increase in demand, at 29%.

North London registered the largest drop in demand, 33% down year on year.

There were 19 renters competing for every new property in January 2023, 8% lower compared to the same month last year.

Yet this is still significantly higher than the 11 renters per instruction seen in January 2020 and 2021.

South and West London were the most competitive areas in January 2023, with 29 and 27 renters per new instruction respectively.

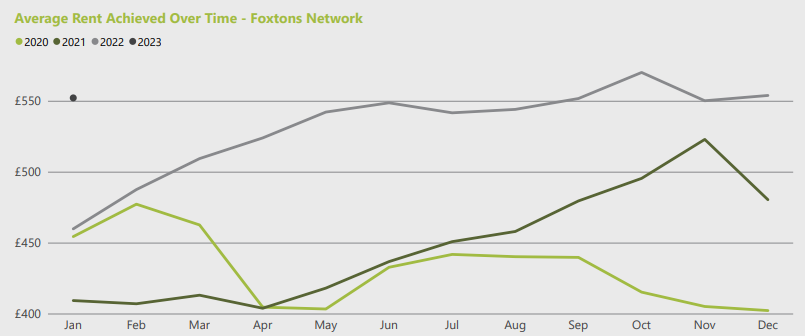

The average rent in January 2023 remained flat for the third consecutive month, hovering around the recent record highs.

This figure is 20% higher compared to January 2022, demonstrating the intensity of competition between renters in the London market.

Foxtons data found that rent has been rising across all areas of London, with increases of 25% in Central London, 20% in South London and 19% in East London.

A three bed flat saw the highest year on year increase in average rental price, up 25% on January 2022.

|

Supply New Instructions YoY |

Demand New Renter Registrations YoY |

|

| All London | 5% | -4% |

| Central | 9% | -14% |

| East | -16% | -10% |

| North | -12% | -33% |

| South | 27% | 7% |

| West | 9% | 29% |

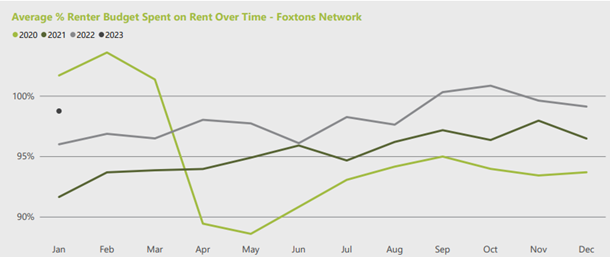

January 2023 had an average applicant budget close to £500 per week, which is the highest figure recorded by Foxtons in any January over the last four years.

This is 9% higher compared to January 2022 and 2% higher than December 2022.

Although renters in every area of London increased their budgets from last year, North and East London had the most notable uplift at 15% and 13% respectively.

In January 2023, renters spent 99% of their property budgets on average.

This remains consistent with December 2022, but 3% higher than January 2022.

In Central and North London, renters spent 100% of their budgets to secure a tenancy, whereas renters in other regions spent just under.

Industry data shows that new listings in January rose 61% higher than in December 2022.

However, year on year, new listings were 7% lower than January 2022, continuing the long-term trend towards fewer listings that has been underpinning higher rent prices.

Gareth Atkins, Managing Director of Lettings, said:

“With a 7% decrease year on year, January has seen the same long-running trend of low lettings supply that has fed the bottleneck on London’s high demand and driven up competition and prices across the Capital.

2022 pricing is likely to continue into 2023, but at a steadier incline than last year’s sharp rises, and more in line with conventional market trends.

There is an opportunity for enterprising landlords to invest in the buy-to-let stock that’s come to the market this new year and contribute to London’s supply of homes to let.”

Sarah Tonkinson, Managing Director of Institutional PRS and Build to Rent, said:

“Renters may need to change tactics in the coming year, setting aside more time for their property search and preparing to move fast when they see something they like.

Our research suggests the market will grow steadily, with property coming to the market throughout the year instead of concentrated around the typical summer peak.

This January had the highest average applicant budget we’ve reported in four years, as savvy renters hit the new year running.”

Comments