- The level of ‘significant’ financial distress leapt 30.8% year-on-year in Q1 2024 with 554,554 companies affected (Q1 2023: 424,041).

- Each of the 22 sectors covered by Red Flag Alert research experienced a double-digit growth in financial distress over the last year.

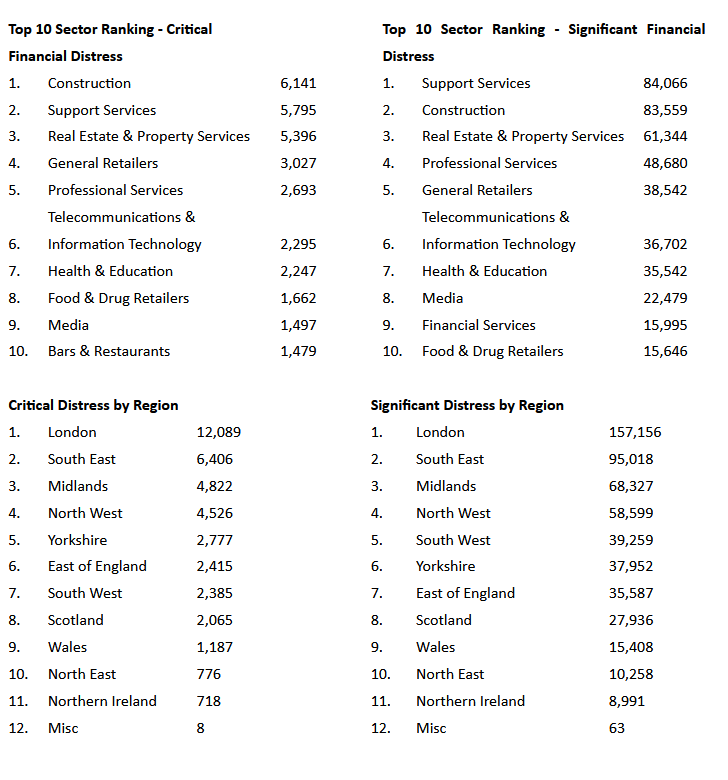

- The Construction, Food & Drug Retailers and General Retailer sectors in particular drove the increase in ‘significant’ financial distress, up 38.6%, 40.8% and 38.7% respectively in Q1 2024.

- 40,174 UK businesses are in ‘critical’ financial distress – a 20.1% increase compared to Q1 2023 (33,449) making them especially vulnerable to failure over the next 12 months.

The latest Begbies Traynor “Red Flag Alert” research, which has provided a snapshot of British corporate health for over 15 years, highlights the speed at which financial distress has accelerated over the last 12 months, with 554,554 UK businesses now in ‘significant’ financial distress – a 30.8% rise compared to Q1 2023. This deterioration now affects all 22 sectors covered by this latest research.

Additionally, the much more serious ‘critical’ financial distress has leapt 20.1% compared to Q1 2023, with 40,174 UK businesses affected. Despite a 15.4% fall in critical financial distress compared to Q4 2023 company insolvencies remain at historically elevated levels as servicing debt at higher interest rates takes its toll.

With many companies in ‘critical’ financial distress expected to enter insolvency over the course of the next 12 months, the picture in the Construction, Real Estate, Financial Services and Support Services sectors is particularly concerning as nearly 50% (c.20,000 businesses) of the companies in ‘critical’ financial distress are represented by these sectors.

Additionally, Red Flag Alert’s historic data indicates that a large percentage of the businesses currently in ‘significant’ financial distress are likely to progress towards ‘critical’ financial distress and potential insolvency if the economic backdrop does not improve.

Julie Palmer, Partner at Begbies Traynor, said: “Despite some optimism as we entered the new year, 2024 has so far been characterised by a continuation of the same pressures that plagued companies in the UK throughout 2023.

“Since the pandemic, hundreds of thousands of UK businesses depleted their financial reserves and loaded their balance sheets with increasingly unaffordable debt which for many may simply be too great to bear.

“As with the prior quarter, the picture is particularly concerning in the consumer facing sectors. We are starting to see this translate into larger companies entering insolvency, a trend that I expect to continue while consumer confidence remains uncertain. On top of that, the higher levels of financial distress in bellwether sectors such as real estate and construction point to a troubled UK economy.

“Right now, many companies will be pinning their hopes on a meaningful cut to interest rates later this year, but the Bank of England continues to be hawkish, so it is unlikely to make a cut in the near-term given inflation is still higher than expected.

“All of this means that these pressures are here to stay, and I fear this will result in thousands of businesses failing in the coming months as the constant pressures will become too great for many.”

Ric Traynor, Executive Chairman of Begbies Traynor, commented: “We are three months into 2024 and the considerable economic challenges facing many companies up and down the UK show no immediate sign of abating. The macroeconomic conditions that made last year so difficult have continued to exert unrelenting pressure on corporate balance sheets.

“Consequently, our own red flag data shows a marked increase in British firms moving towards insolvency compared to the same period last year.

“Growing geopolitical instability is compounding this problem and impairing the UK economy’s ability to pick up some much-needed momentum post-pandemic. The UK economy is in a precarious enough position as it is, and further instability could cause fuel prices to rise markedly, increasing inflation and slowing the appetite for the predicted cuts to interest rates.

“Unfortunately, there’s no quick fix for our economy and with inflation falling slower than expected, hope of the Bank of England cutting interest rates significantly in the near future seems to be fading.

“Sadly, the pressing issues facing businesses today will simply push many over the edge and contribute to the current high level of UK corporate insolvencies.”

Comments