New figures today from Foxtons, London’s leading lettings agent, show that the average rent in February 2023 rose 5% from the previous month, reaching over £570 per week, which exceeded the highs of the peak lettings season last summer.

Rental prices in Central London were higher than other areas of London and 23% higher year-on-year this February.

Continued demand in the lettings market was highlighted by the 6% increase in competition for each new instruction last month, rising to 20 renters per instruction.

South and West London had the highest number of renters competing for every new instruction – 29 and 31 respectively.

The number of properties coming to the market in February was down 5% compared to January, and 4% down year to date compared to last year, according to Foxtons analysis of Zoopla data.

The Central London boroughs of Westminster and Tower Hamlets had the highest concentration of new lettings instructions coming to market, as supply remained tight.

Foxtons found that applicant registrations in February were down 7% compared to January 2023, and down 1% compared to 2022 year to date. So far in 2023, South and West London have proved to be more popular compared to last year, with applicant registrations up 16% and 30% respectively.

|

Supply New Instructions YoY |

Demand New Renter Registrations YoY |

|

| All London | 3% | -1% |

| Central | 6% | -12% |

| East | -15% | -16% |

| North | -9% | -24% |

| South | 21% | 16% |

| West | 10% | 29% |

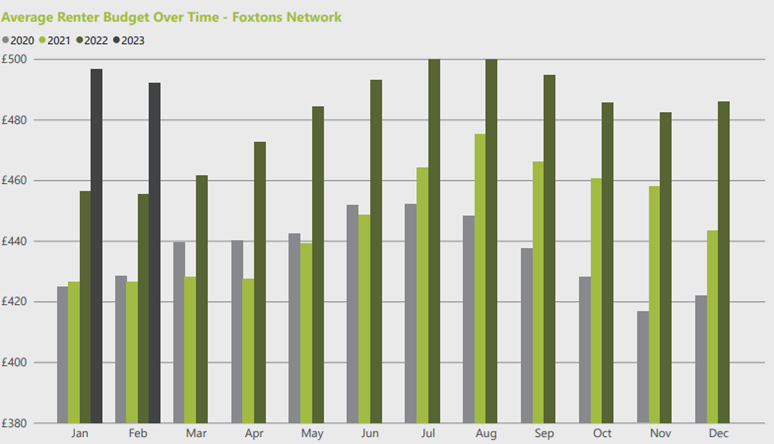

Foxtons data found that average budgets for applicants remained flat, with just a 1% reduction compared with the previous month.

However, applicant budgets were still 8% higher compared to 2022 year-to-date, with renters understanding and adjusting to the financial requirements of the current lettings market.

Although average renter budgets have increased in all areas of London this year, renters looking to secure a property in North and East London increased their budgets by 15% and 14% respectively in February.

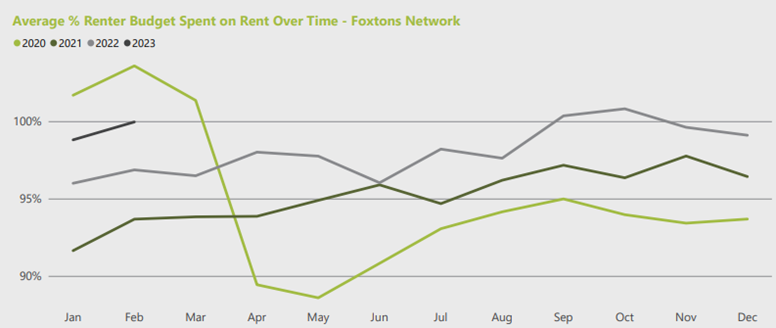

On average, renters spent 100% of their budget in February to secure a tenancy, which was 3% higher year-on-year and 1% higher compared to January.

Renters looking to live in Central London spent over-budget at 103%, whilst renters were able to spend under budget in other areas of London.

Gareth Atkins, Managing Director of Lettings, said:

“Considering how 2022’s prices climbed through the latter end of the year, we did expect higher prices in Q1.

February’s unseasonable rise in average rent price, higher than last year’s record-breaking peaks at over £570 per week, is a strong indicator of how intense the imbalance is between supply and demand in the London lettings market.

This month, we’ve seen many more tenants choosing to extend their lease, so those properties aren’t coming back onto the market.

At the same time, we’ve found a remarkable increase in corporate searches as businesses take the opportunity of favourable currency rates to invest in new London offices, raising demand.”

Sarah Tonkinson, Managing Director of Institutional PRS and Build to Rent, said:

“With 20 renters registering per each new property on the market, right across London, we are in the midst of an unbelievably competitive first quarter.

Budgets have increased in every region, and average rent has, once again, broken records.

However, despite the low rental supply in London, there was an interesting increase new listings in the boroughs of Westminster and Tower Hamlets.

Sudden opportunities like this will crop up across London through the year, and our local experts work with renters to get them matched and into their new homes at pace in this fast-moving market.”

Comments