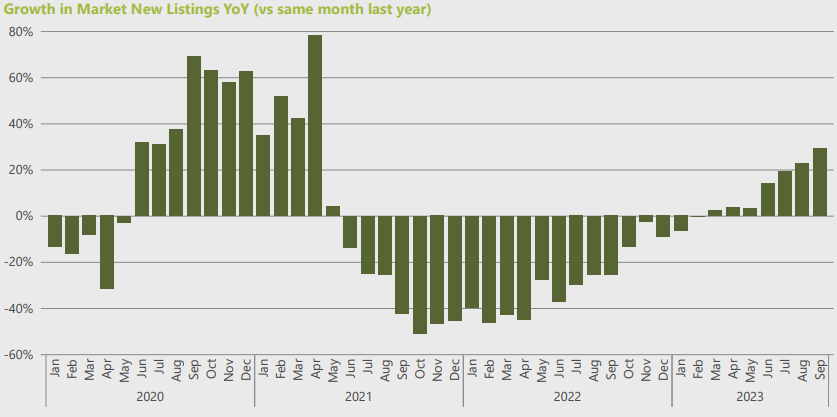

Last summer the London market experienced unprecedented low levels of rental stock, but this year new figures from Foxtons, London’s leading lettings agent, shows a move towards a more traditional market and increase in available properties as summer 2023 draws to a close.

New listings over time have been growing steadily through the year, with a 10% increase in supply of rental properties compared to the same period in 2022.

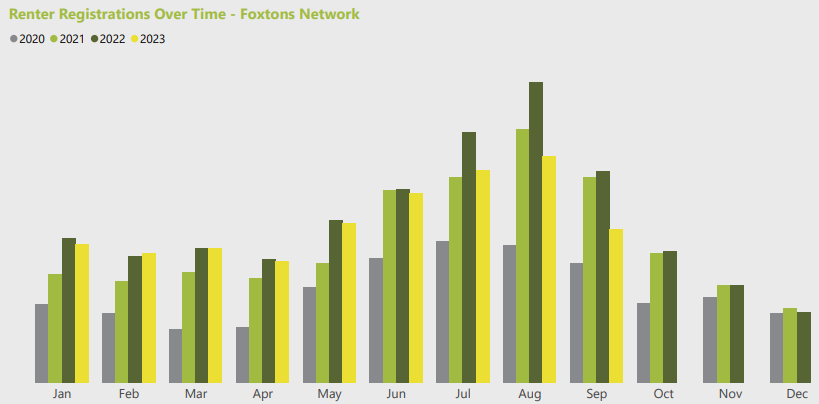

As the supply of rental property increased and tenant demand normalised, the number of new renters fighting for each instruction was down year-on-year and month-on-month.

In September, there was an average of 19 renters per new instruction across London, which was a 19% decrease compared to the previous year and a 17% decrease from the previous month (August).

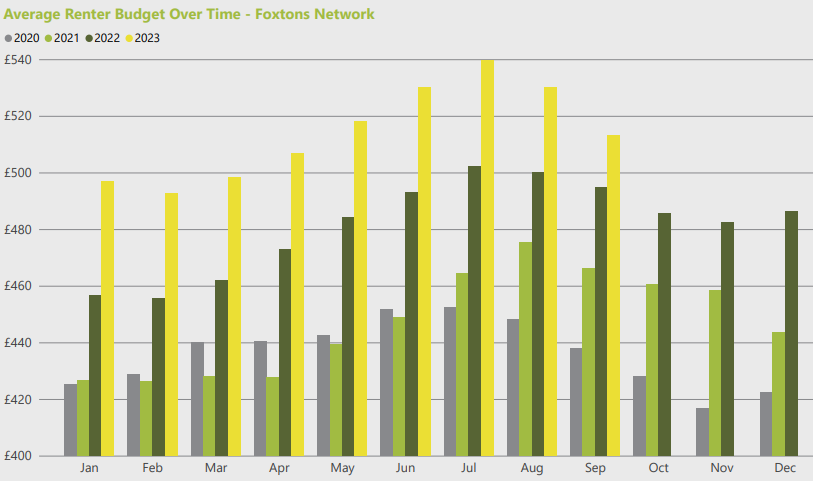

Despite the increase in rental supply, prices remained high compared with last year, up 10% year-on-year, while month-on-month there was no change, with little movement in rental prices since May 2023.

Applicant budgets continued to grow compared to previous years, despite a seasonal 3% decline from August to September.

Month-on-month supply decreased 13%, according to Foxtons analysis of Zoopla data, while demand fell 32% month on month, in line with market dynamics towards the end of peak lettings season.

Westminster continued to show the largest proportion of new market instructions year to date, accounting for 11% of London’s new lets.

The average percentage of rental budgets spent to secure a property has remained stable throughout the year, sitting around 99%, which was the average renter spend in September.

The highest average spend for the year was in May, at 101%, Foxtons’ data shows.

Foxtons year to date key market indicators

| Supply New Instructions (year on year) |

Demand New Renter Registrations (year on year) |

|

| All London | 10% | -11% |

| Central | 11% | -18% |

| East | 15% | -8% |

| North | 10% | -10% |

| South | 15% | -7% |

| West | -5% | -14% |

Gareth Atkins, Managing Director of Lettings at Foxtons, said:

“Supply of rental properties in London has increased 10% compared to this time last year, which is very welcome news.

However we are still behind the levels we’ve seen in 2019, 2021 and of course the post-lockdown market of 2020, so we’re not back to a normal seasonal market just yet.

Prices continue to be at record levels and I don’t expect that to change significantly in the short term, given we are currently still registering 18 tenants for every property we have on the market.”

Sarah Tonkinson, Managing Director of Institutional PRS and Build to Rent at Foxtons, said:

“As we head into Q4, budgets and prices remain high.

Renters that move this time of year are often already living in London, know exactly what they want and are experienced at renting in the capital.

They will be searching for good value in the properties they choose view and ultimately rent.

With higher – but not plentiful – stock levels, landlords will need ensure they are well priced to attract renters.”

Comments