London’s £10 million-plus (super-prime) property market has had its strongest year since 2016, as the restrictions of the pandemic lift and the uncertainty of the Brexit vote fades.

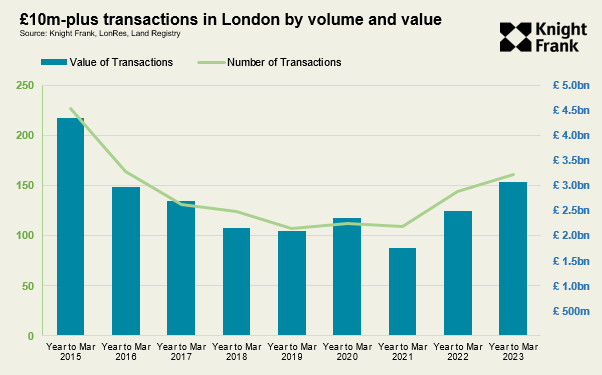

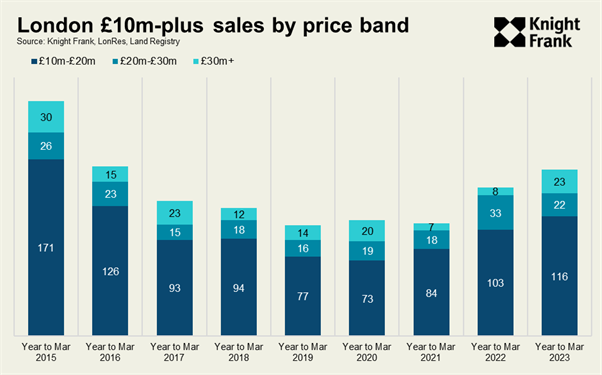

A total of £3.1 billion was spent on 161 super-prime properties in the year to March 2023, whole-market data shows.

It compared to £2.5 billion and 144 transactions in the previous 12-month period.

The last time there were more sales was in 2015/16 (164).

The highest amount spent in the last decade was £4.3 billion, which was spread across 227 transactions in 2014/15.

Demand was boosted as international travel resumed from many parts of the world last year.

The political uncertainty that followed the EU referendum in 2016 had begun to dissipate following the election of a majority government in December 2019 but Covid struck four months later.

“After everything that has happened in recent years, London is still highly-regarded by global buyers,” said Paddy Dring, global head of prime sales at Knight Frank.

“However, I expect sales volumes will decline by at least 10% over the next 12 months as political and economic uncertainty picks up.”

The decline would be in line with the wider UK property market, which is still recovering from the shock of the mini-Budget.

Sales volumes across the UK were 18% down in the first two months of this year compared to 2022 but are rising steadily as mortgage rates stabilise.

A strong year for the super-prime market year came despite the fact the collective wealth of ultra-high net worth individuals (net worth of US$30m-plus) around the world declined by 10% in 2022 as economies dealt with an energy price crunch and fast-rising inflation and interest rates. The Knight Frank Wealth Report provides further insight.

This year, the bailout of Credit Suisse in March and wider concerns around the health of smaller banks has caused some hesitation.

Meanwhile, the next UK general election, which is expected in 2024, is moving onto the radar. Issues such as the taxation of wealth and property and the status of non-doms are likely to come under growing scrutiny.

“Discussions around the general election have started to creep into conversations,” said Christian Lock-Necrews, head of the Knightsbridge office at Knight Frank.

The highest number of £10 million-plus deals in London took place in Kensington (26), followed by Belgravia (25) and Mayfair (22).

Meanwhile, the popularity of houses declined slightly from last year.

Some 67% of sales were houses compared to 70% in the year to March 2022, a period when lockdown restrictions increased demand for space.

In the 12 months before the pandemic, 60% of transactions were houses.

“Houses still have the edge over flats which means there is a shortage of stock in areas like Notting Hill and Belgravia,” said Paddy.

A declining number of luxury new-build flats coming to the market may keep the ratio of house sales relatively high.

The number of units consented, under construction or delivered every year in developments where the blended value is £3,000 per square feet and above will fall sharply over the next five years.

A figure of 1,364 in 2022 compares to 146 by 2027, although the number will rise as consented schemes come through the development pipeline.

“There will be a material reduction in the amount of new-build stock over £10 million compared to 2014,” said Rupert des Forges, head of prime central London developments at Knight Frank.

“Significant prime schemes are still coming through, but buyers need to be aware of this relative shortage.”

Average prices above £10 million rose by 0.5% in the year to March, which is the same increase recorded in the three years since the pandemic first struck in March 2020.

This relatively flat performance is something Knight Frank explore in more detail here.

Knight Frank expect prime central London prices to decline by 3% this year, outperforming the wider UK housing market due to higher levels of affluence and cash sales, the return of international travel, the currency discount and the fact prices are still 14% below their last peak in 2015.

US dollar-denominated or pegged buyers still benefit from an effective discount of 37% in prime central London compared to July 2014 when the movement of the pound and property values are combined.

Meanwhile, both supply and demand were relatively strong in the first quarter of this year compared to the five-year average, underlining the likely resilience of the market this year.

The number of new prospective buyers registering above £10 million rose by 15% while the number of properties coming to the market for sale increased by 11%.

Tom Bill, head of UK residential research at Knight Frank said:

“The gyrations in the mortgage market at the end of last year had a limited impact on the ability of buyers above £10 million to purchase property.

Half of transactions inside zone 1 are typically in cash.

Like all buyers though, it created uncertainty around the trajectory for house prices so would have caused a degree of hesitation.

Now the mini-Budget has become a distant memory, lending rates have stabilised, recession forecasts have been revised away and UK price declines appear to be bottoming out, the outlook for 2023 is reassuringly stable after three eventful years.

The same is unlikely to be true next year as political volatility rises.”

Country Super-Prime Market Sees Record Year Even as Pandemic Winds Down

Tight supply and resilient demand mean buyers looking to secure a prime property outside London are still facing strong competition even as the ‘race for space’ calms down.

There were 52 sales at £8m+ outside of London in the 12 months to March 2023, whole market data shows.

This was an increase of 16% on 45 a year earlier and the highest total in 15-years.

Sales at £5m+ reached 122 in the same period, which was the second highest total in the last 15 years.

There were 157 sales in the 12 months to March 2022.

As well as the ‘escape to the country trend’, strong demand for high-value property outside of London is the result of wealth creation that has taken place in recent years, as well as the relative value compared to London over the last decade.

There was a 14.4% increase in the number of high-net-worth individuals (HNWI) in the UK in 2021, taking the overall number to close to five million, according to The Wealth Report.

A HNWI is someone with a net worth of US$1 million or more, including their primary residence.

In the decade to March 2020, the average price of a £5m+ property outside of London fell 5.5% while at the same price point prices in PCL climbed 14%.

Higher borrowing rates have also placed cash buyers – 77% of country buyers at £5m+ bought in cash last year – in a relatively stronger position, as Knight Frank have explored.

“There are plenty of buyers in the market and the best properties are still selling quickly. Anything that needs updating or work done is taking slightly longer to sell as there’s less appetite among buyers to take on a project due to the increase in building costs,” said Tom Hunt from Knight Frank’s Country Department.

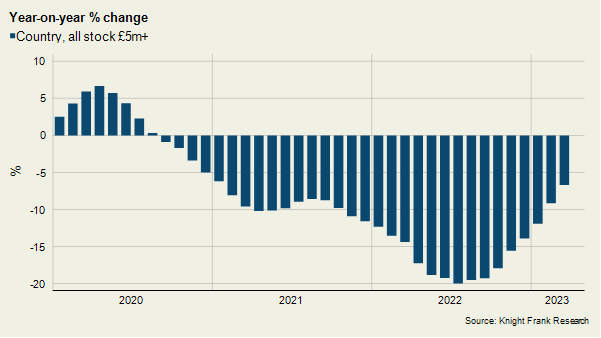

Supply was 7% down in the 12 months to March compared to the previous year, which shows how it is picking up from a low base.

Prime regional prices at £5m+ have increased by 36% over the course of the pandemic, although they declined 0.9% on a quarterly basis in Q4 2022.

It’s expected that prime regional prices will fall by a few percent this year.

The number of new prospective buyers looking for £5m+ property outside the capital has declined from a peak in the third quarter of 2020.

However, it remained 13% above the five-year average in the first quarter of 2023.

“We’ve seen a shift in priorities.

People deciding to move that rung further outside of urban centres knowing that they don’t have to be right on top of a station as they are now only in the office three days a week,” said Ed Rook, head of the Country Department at Knight Frank.

Comments