Recent media reports (including in The Sunday Times, Property Industry Eye, Estate Agent Today and The Guardian) have stated that the Government has abandoned plans to reduce ground rents to ‘a peppercorn’ – which was originally trailed in November’s King’s Speech, the Leasehold and Freehold Reform Bill and in a ground rents consultation which closed earlier this year.

This comes amid concerns that the plans could wipe out between £15 billion and £40 billion of investment, effecting pensions and others.

In addition to the ground rents issue, government lawyers have warned that making retrospective changes to property rights could leave ministers open to legal challenges.

ALEP (the Association of Leasehold Enfranchisement Practitioners) is a professional body representing over 1,200 solicitors, barristers and surveyors who work in leasehold enfranchisement and have experience of dealing with ground rents from a variety of perspectives.

Commenting on the speculation of a change in policy direction, Mark Chick – Partner, Bishop & Sewell LLP and a director of ALEP said:

“If this announcement/leak is correct, it may well be seen as a victory for common sense. In many quarters there was consternation as to the possible impact that an outright ban might have and certainly ALEP members in general did not favour the option of an outright ban in their responses to the consultation. The wider policy considerations have clearly been considered here and perhaps quite rightly so, rather than the government getting entangled in a human rights challenge ‘after the event’ at potentially no small cost to the taxpayer.

“There are a number of other options as discussed in the consultation and this piece of news does not say which of these other measures may find favour, save that to say that the prospect of £250 cap might still be on the cards. There are various other options that might come out of the consultation such as a per centage cap or a freeze on current levels and we eagerly await the formal outcome of the DLHUC consultation, which we might now guess will be soon.”

ALEP member, Clive Scrivener, a Partner at Scrivener Tibbatts said:

“There are some sensible heads at the Treasury and in Downing Street. They have confirmed what many independent experts in the sector believe; that the Government cannot just “wipe out” ground rents which are payable under long leases. The current law (Leasehold Reform Housing and Urban Development Act 1993, as amended), has given leaseholders the rights to reduce their ground rent payments to a peppercorn and extend their lease term by 90 years plus the existing unexpired term for the payment of a premium value (compensating the landlord for their loss of ground rent income and reversion), for over 30 years. Although leaseholders may feel aggrieved at having to pay a premium, it is important to remember that anyone purchasing a leasehold flat is advised by their conveyancing solicitor and should be fully aware of their obligations under the lease including any ground rent which might be payable and any review terms.”

ALEP member, Eleanor Murray, a Partner at Cameron McKenna Nabarro Olswang LLP said:

“Ahead of a formal response from Government following the ground rent consultation in January, this appears to be a sensible and pragmatic approach from Government. Reducing existing ground rents to a peppercorn would be a bold move indeed and a human rights challenge would be inevitable. Government appears to be recognising this reality. Whilst there is a balance to be drawn between protecting leaseholders and upholding the terms of the contract entered into by parties when the leases were granted, the reality is that an outright ban in existing leases would be a case of robbing Peter to pay Paul with the inevitable bill for compensating landlords being settled ultimately by the consumer. We await with interest the final outcome including Government’s conclusion on the other options tabled.”

Earlier this year ALEP conducted a survey in which 81.8% of members agreed with the statement that ‘residential ground rents can have a negative or undesirable impact on the sale of leasehold properties’, while just 18.2% disagreed.

ALEP’s consultation, mirroring the government’s, considered the potential negative impacts of ground rents and how they can be mitigated.

70% said that some ground rents could cause problems in when selling a property and 43.2% said that problems occurred because the full terms related to ground rent payments had not been made clear when the vendor purchased the property.

ALEP’s members’ answers appear below:

Think about how leaseholders experience ground rent. What do you see as the key problems that ground rents are causing for leaseholders?

- That the property cannot be bought or sold because mortgage providers do not like the ground rent terms (70%)

- That the full terms related to ground rent payments are not initially made clear when buying the property (43.2%)

- That leaseholders do not know or understand how much their ground rent will increase (31.8%)

- That ground rent payments get more expensive over time (27.3%)

- That leaseholders do not know or understand when their ground rent will increase (27.3%)

- That leaseholders have to pay a ground rent payment for no clear service given in return (25%)

- That ground rent payments are unaffordable (6.8%)

- No problem (2.3%)

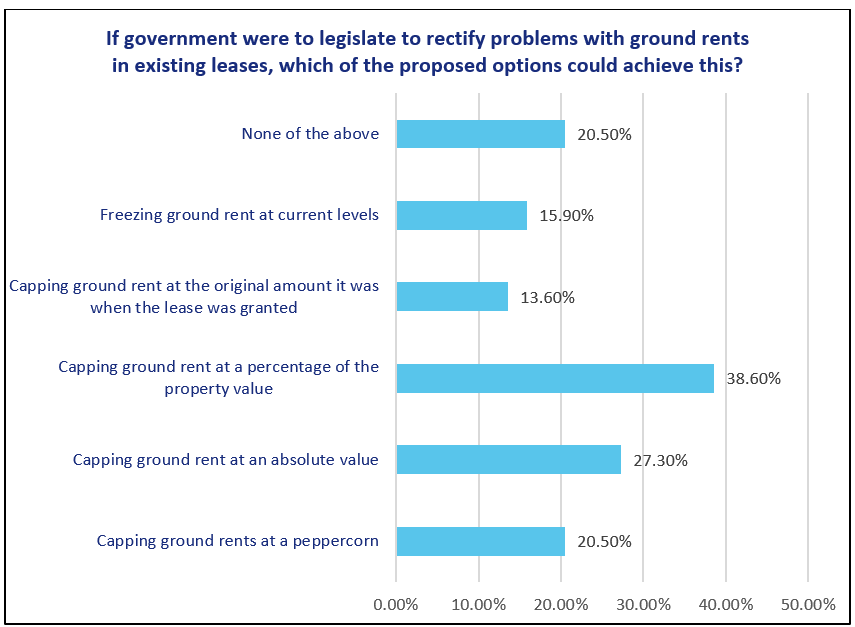

The consultation went to identify which of the government’s proposals to rectify issue were most appropriate. Members determined that the best potential solutions are capping ground rent at a percentage of the property value (favoured by 38.6%), capping ground rent at an absolute value (27.3%) or capping ground rents at a peppercorn (20.5%)

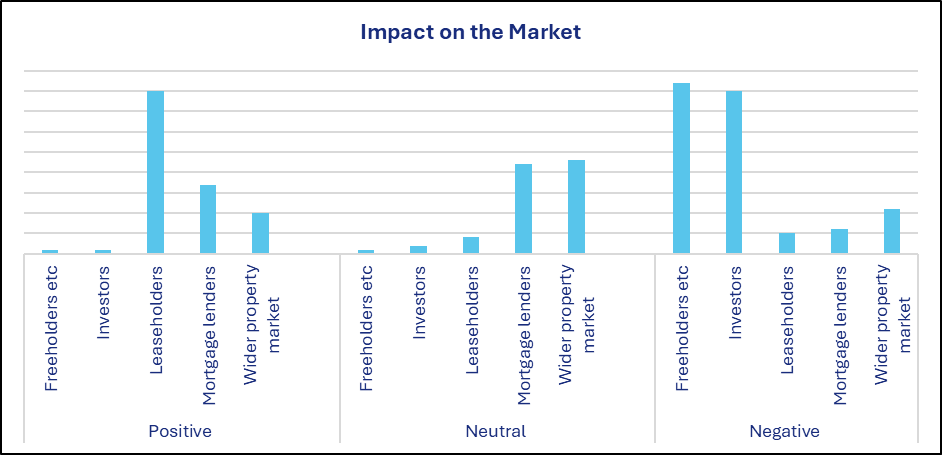

Of these options, the government’s stated preference is to cap ground rent at a peppercorn. ALEP members believed that whilst this would very significantly benefit all leaseholders. The of this impact would be disproportionately harsh on freeholders and investors who would experience an extremely negative impact.

Respondents considered the potential impact on various groups: freeholders/intermediate landlords, investors (including local authorities pension funds and others), leaseholders, mortgage lenders, the wider property market (developers conveyancers estate agents etc.).

Comments