The Bank of England paused its cycle of interest rate hikes in September, but demand for residential property remains fragile.

While the number of new prospective buyers in London rose 12% between August and September as this year’s autumn market began, it was half the increase experienced in the previous two years. In calmer political times before 2016, the same jump exceeded 40%.

Essentially, the prime London property remains in a holding pattern.

It has not experienced the extent of price declines seen across the UK but neither have the capital’s more affluent postcodes been immune from the deteriorating economic sentiment.

The Nationwide index recorded its second consecutive annual decline of -5.4% in September, while prime central London experienced a more modest 1.7% fall.

In prime outer London, the decrease was 1.4%.

Last month’s pause by the Bank of England added to a sense that we have gone through the eye of the storm.

Indeed, Knight Frank has updated its forecasts to reflect the fact we expect most of the decline in house prices across the UK will take place this year.

Knight Frank are forecasting a 3% decline in both prime central and outer London this year, as those markets continue to outperform the rest of the UK in terms of trading activity as well as price performance.

The number of new prospective buyers across the UK was 11% down in the third quarter of this year compared to the five-year average, while the figure for London was up by 13%, Knight Frank data shows.

Meanwhile there was a 14% increase in exchanges in the capital while sales volumes fell by 9% across the country.

The primary reason for this resilience is the fact average prices are still 16% below their last peak in 2015 in prime central London. In prime outer London, they are still 8% down.

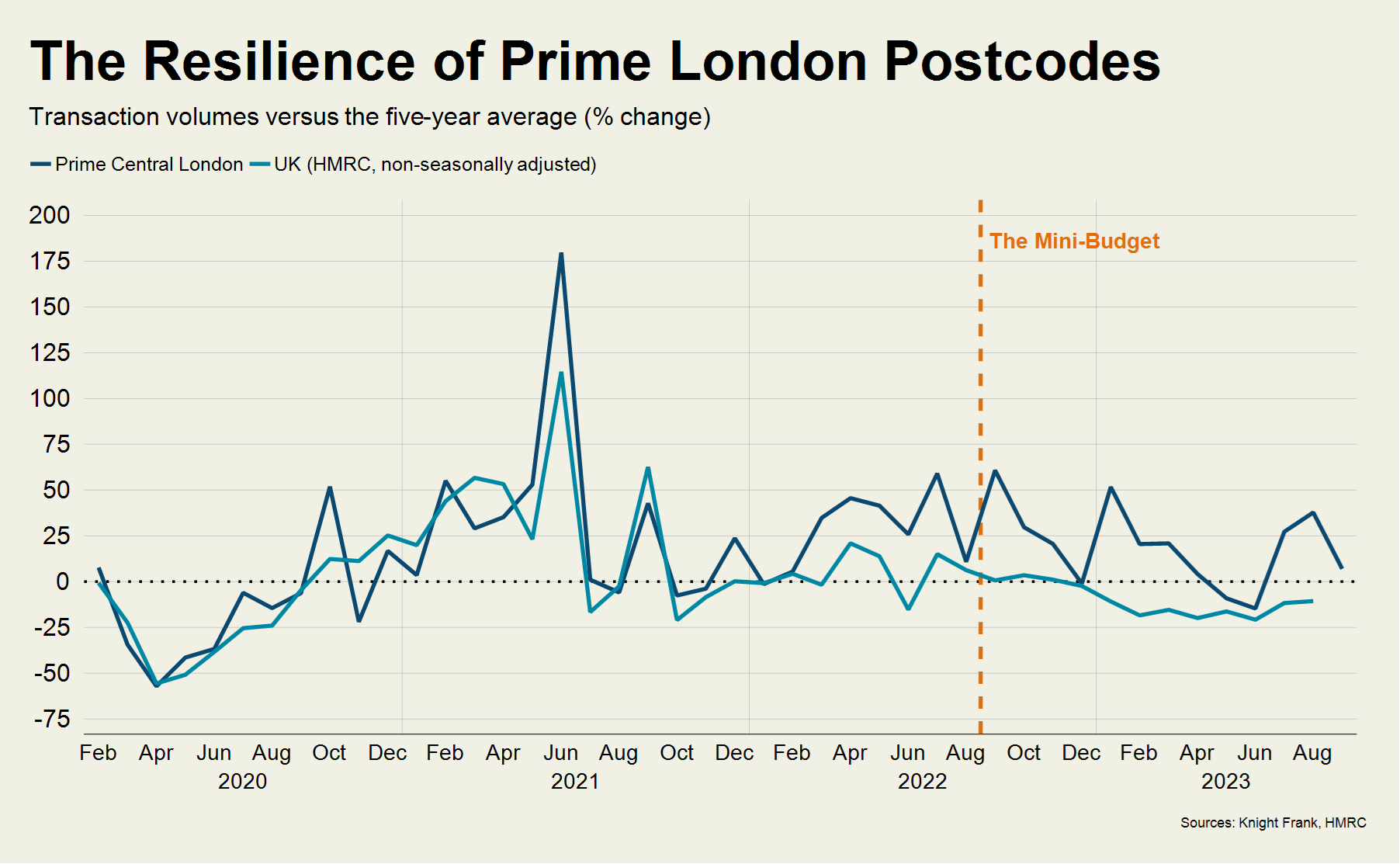

Average prices are also 2% lower than they were before the pandemic in PCL, which helps explain why transaction volumes were 7% higher than the five-year average in September, as the chart shows.

Meanwhile, across the UK, there was an equivalent 11% decline in August, non-seasonally adjusted figures from HMRC show.

Knight Frank are predicting a 7% decline in UK prices this year, which would still leave them more than 10% higher than before the pandemic.

In a departure from what took place after the global financial crisis, property prices in London have been far less volatile than the rest of the country during this latest period of economic turbulence.

Comments