The Bank of England announced that it is keeping the interest rate at 3.75% on 5th February, which goes against what forecasters were predicting just before the end of 2025, which was estimated it would be reduced to 3.5%. Yet, it was also a very close vote.

The Monetary Policy Committee (MPC) voted by a majority of 5–4 to keep it on hold, but this does suggest we aren’t far off from another cut in March, if inflation starts to fall.

However, as the Bank of England pointed out, they had made six rate cuts since August 2024, which has had a positive impact on mortgage rates, which, for those buying a new property or remortgaging, have reduced. The full Monetary Policy Summary and Minutes can be found here.

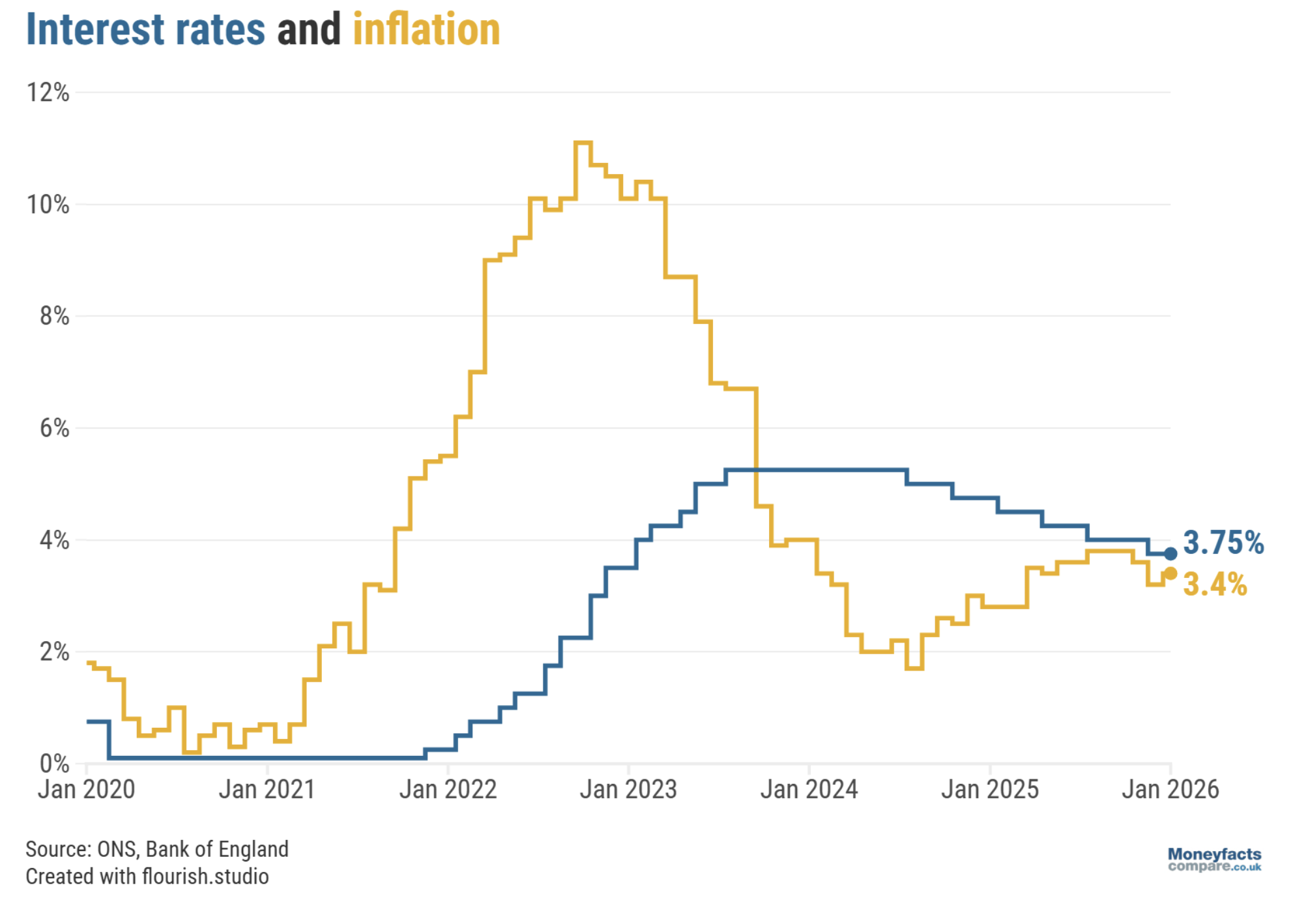

The reason for the hold is that the Bank of England really want to see inflation reduce to the 2% target and, as it was for the first half of 2025, inflation remains stubbornly above 3.5%. December’s inflation recorded at 3.4%, so with this in mind, it’s clear the MPC don’t want to add further pressure to Inflation and risk market volatility.

Interest Rates and Inflation

The base rate is set by the Bank of England to overall influence and be a primary driver of the interest rates set by banks and building societies. The decision to maintain the current base rate largely reflects the MPC’s cautious approach to managing inflationary pressures. The MPC comes to every meeting to “judge the latest information and data at each of our meetings and set whatever interest rate is necessary to make sure that inflation stays low and stable.”

The graph below from Moneyfacts Compare shows inflation was recorded as 3.4% in January 2026 and a base rate of 3.75% based on the latest announcement:

Source: Moneyfacts Compare

What does this mean for the UK property market?

Despite forecasters hoping for reductions in sight at the start of 2026, leading industry UK property market experts agree that stability is always a welcome move when it comes to the UK property market. Richard Deacon, Managing Director from Octane Capital, states, “While many had hoped for a further cut, this pause reflects a Bank that is keen to avoid moving too quickly, even as inflation continues to cool. For the property sector, however, stability is often just as valuable as outright reductions, especially after a prolonged period of rate volatility.”

Lucy Waters, Managing Director and Founder of Aria Finance, takes a similar stance, commenting: “Stability is no bad thing, and the base rate decision keeps rates where the market broadly expected them to be. While there had been hopes of reductions earlier in the year, inflation and wider economic data continue to make the timing of any cuts uncertain. That uncertainty remains, but it is no longer being driven by sharp market moves. The narrow 5–4 vote also highlights how close the decision remains, reinforcing that the direction of travel is finely balanced rather than fixed.”

It’s clear that despite a hold, there seems to be a positive move within the UK property market overall. Ryan Etchells, Chief Commercial Officer at Together, comments that whilst “The Bank of England remains firmly in ‘wait‑and‑see’ mode, with hopes of early rate cuts tempered by inflation. However, while policymakers pause, the property market continues to move forward. The year has started with a noticeable spring in its step, as buyer demand picks up and the fog of late‑2025 uncertainty begins to clear.”

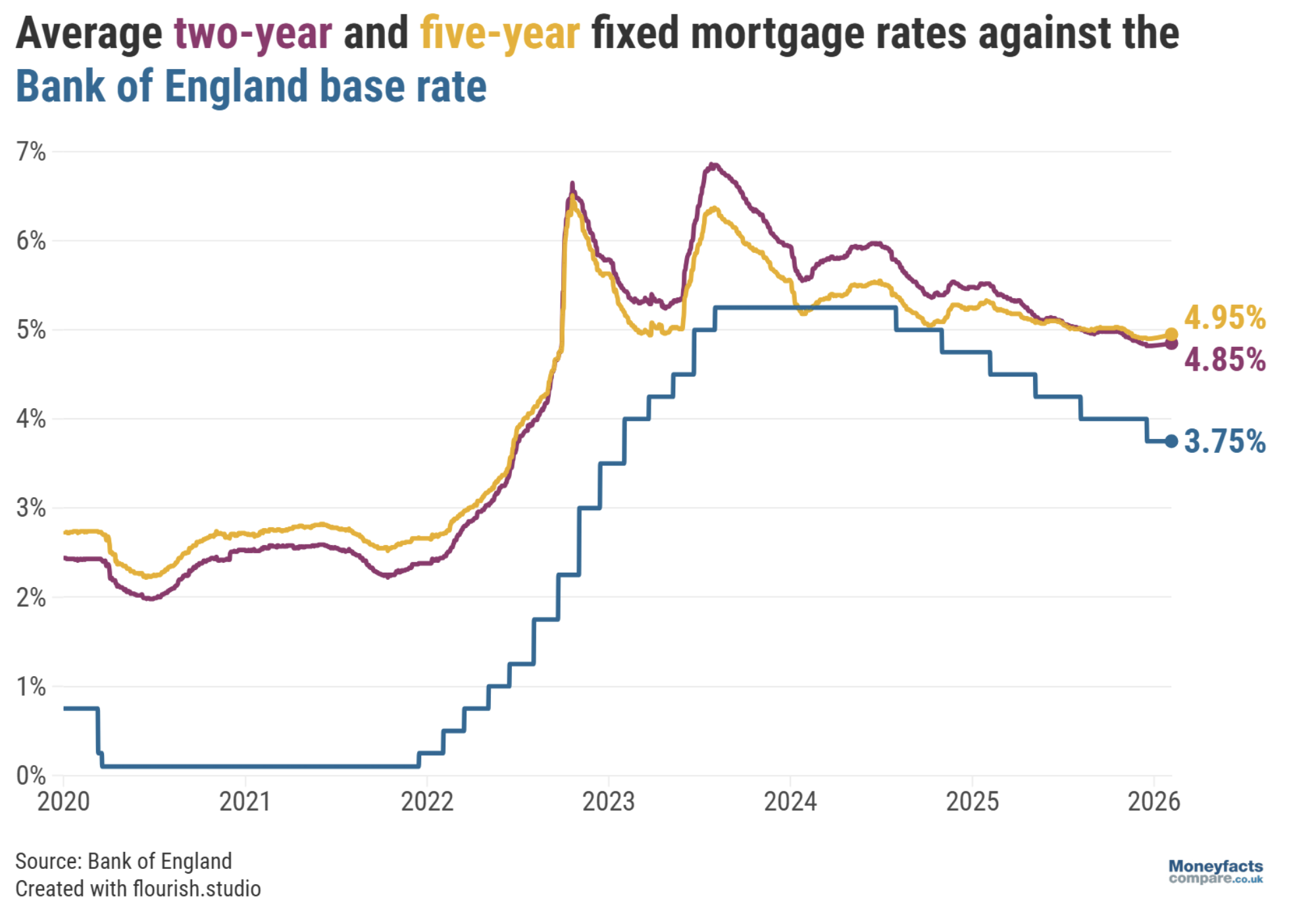

What does the Base Rate hold mean for mortgages?

It’s clear that a market of stability over volatility is a good thing when it comes to mortgage rates, as we’re now in a place where mortgage rates are falling and hence cheaper for borrowers. Looking at this graph from Moneyfacts Compare, we can see that the average two- and five-year fixed rates finally fell below 5% in 2025 (reaching 4.85% and 4.94% respectively at the start of this month) for the first time since 2023.

Source: Moneyfacts Compare

Whilst there will be no immediate changes to rates or repayment, also be changes to savings, it’s important to note that further mortgage rate cuts are near. Ryan Etchells, Chief Commercial Officer at Together, comments on these very predictions: “For borrowers on tracker and variable rates, the base rate hold decision means repayments stay exactly where they are. Fixed‑rate customers will see no immediate change either, but the BoE’s latest decision puts on pause hopes that significant savings from mortgage rate cuts are just around the corner.”

It also signals some positive moves for the lender and borrower’s confidence in the long-run. Richard Deacon, Managing Director from Octane Capital, comments: “From a lending perspective, a steady base rate helps lenders maintain confidence in their pricing and funding strategies. This supports continued competition across specialist and buy-to-let products, which is crucial for keeping deals flowing in a market that remains sensitive to pricing.”

It’s also worth noting that the base rate alone is not the only factor in having an impact on the mortgage rate, as swap rates and the overall economic market play a key role. An overall change to base rates won’t directly correlate to mortgage pricing in the immediate term. As Jeni Browne, Business Development Director from MFB, comments: “the Base Rate and fixed-rate mortgage pricing don’t always move in tandem; a fact this week’s lender activity underlines.”

Lucy Waters, Managing Director and Founder of Aria Finance, also makes note of other factors beyond the base rate, stating: “Swap rates have been relatively calm and far less volatile, which is helping confidence return gradually rather than in bursts. This allows borrowers and lenders to make decisions with greater clarity, even without an immediate change in base rate.”

Neil Louth, CEO of The Acorn Group (part of LRG), also comments that: “The good news for home movers is that the mortgage market does not wait for the MPC. Lenders have already been repricing, competition is back, and we are seeing sharper two-year and five-year fixed rates. Affordability testing is easing too, which can help buyers access higher borrowing multiples.”

Looking forward

Looking at the overall trajectory in the voting trends of the MPC at the committee meeting on 5th february 2026 and market forecasts, Neil Louth, CEO of The Acorn Group (part of LRG), comments that looking ahead we should see a move towards a “gradual reduction of the base rate trending towards around 3–3.25% by the end of 2026”.

Jeni Browne, Business Development Director from MFB, summarises the announcement, stating that: Looking ahead, the Bank has signalled that further rate cuts are “likely” as inflation approaches its 2% target, with many anticipating reductions from spring onwards. Should that materialise, we might see BTL rates soften slightly later this year. However, we do need to accept that mortgage pricing as it is now is the new normal, and we won’t see any dramatic reductions.”

A gradual easing of the base rate, rather than sudden changes, is expected to boost confidence across the UK property market. As Richard Deacon, Managing Director from Octane Capital, quotes: “For the property sector, this marks a transition away from a defensive mindset and towards a more measured, opportunity-led approach to investment and development.”

If we go off the market predictions and trajectory, the upcoming MPC meeting on 19th March 2026 is likely to deliver headline decisions that will help shape market direction and expectations for 2026.

Comments