Lettings agency Hamptons believe that rents have peaked. Their latest data reveals some interesting trends in the rental market across Britain:

- Slowing Rental Growth: Average rents on newly let properties increased by 8.3% year-on-year in January, marking the slowest pace of growth in 13 months. This is also the first time in six months that rental growth has been in single digits.

- Decreasing Percentage of Landlords Achieving Higher Rents: In January, 59% of landlords achieved a higher rent when a new tenant moved in, down from a peak of 81% in January 2022 and 79% in January 2023.

- Increase in Rental Homes on the Market: There are currently 34% more rental homes on the market compared to the same time last year, although this is 43% fewer compared to the same period in 2019.

- Regional Variations: While eight out of eleven regions in Britain saw a slowdown in rental growth between August 2023 and January 2024, the most significant slowdown was observed in London, where annual rental growth more than halved.

- Shift in Demand for Property Sizes: The bulk of rent increases in 2022 and 2023 were driven by landlords of smaller homes due to higher demand for cheaper properties amidst a cost-of-living squeeze. However, in early 2024, similar increases are seen across all property sizes.

- Landlords Securing Higher Rents: Despite the slowdown, the share of landlords able to achieve higher rents remains above the pre-pandemic average, indicating that upward pressure on rents has not completely dissipated.

- Future Outlook: While rental growth is expected to weaken in 2024, wider pressures on landlords, such as reduced returns and additional costs stemming from rental reform, are likely to keep rental growth running ahead of inflation.

Overall, while rental growth is slowing, the rental market is expected to remain buoyant, with rents continuing to outpace inflation throughout 2024.

Whilst Allison Thompson, National Lettings Managing Director, Leaders Romans Group asks Will rents keep rising? Stating:

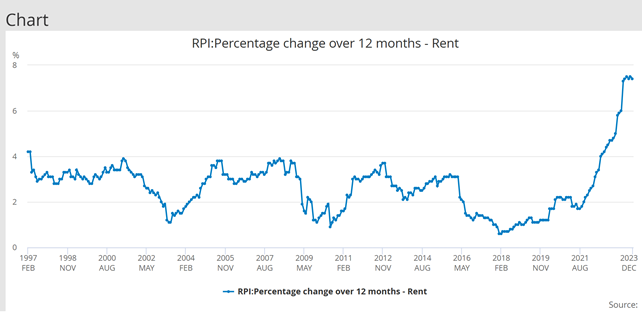

Typically, rents rise in line with wages – which, in turn, tend to track inflation or increase at a slightly lower rate. From the late 90s, when buy-to-let mortgages first became available, and the industry took off, up until the pandemic, that averaged out at around 2-3% a year.

But since the start of 2020, we’ve seen rents in the UK rise at an extraordinary rate, chiefly due to the huge imbalance between supply and demand and competition among tenants driving up prices. Average rents for new lets have gone up by a third in the last three years, with Zoopla’s figures for just the year to December 2023 showing:

- UK as a whole +9.7%

- London +9%

- Scotland +12.9%

Scotland is seeing such high rent rises for new lets because of the current rent increase cap of 3% per year for existing tenancies.

How and why have rents been able to rise?

Quite simply, tenants have found a way to afford them – and it’s important to note that Zoopla’s figures are only for new lets. ONS data, which looks at average rents as a whole, including existing tenancies, shows that for the year to November 2023:

- Average annual rent growth was 6.2%

- Average annual wage growth was 7.2%, with benefits typically rising at a higher rate

And, despite the recent significant rent rises, English Housing Survey data shows that the percentage of income tenants spent on rent last year was slightly lower than a decade earlier: 34% in 2012-13 and 32% in 2022-23. However, if housing support is excluded, that figure rises to 37% which explains why many tenants will feel the pinch.

Will rents keep rising?

Although the rate of growth is now coming down, rents will always rise over time, more-or-less in line with wage growth. And whenever there is an imbalance of supply and demand, that will tend to push rents up if rises are affordable.

For 2024, Zoopla anticipates a significant slowdown in rental growth as affordability impacts demand and supply improves slightly. London and other more expensive areas, where rents are highest, are expected to see the biggest drop, with annual growth in the capital predicted to be just 2% this year.

Rightmove also reports that increasing numbers of tenants are at the affordability limits. Their data shows that in Q4 of 2023:

- Nearly a quarter of rental properties had a reduction in the advertised rent, compared with 16% in the same quarter last year

- Although advertised rents were over 9% higher than in December 2022, the last quarterly increase was just 0.2%

Their prediction for this year is that rents will rise by 5% outside London and by 3% in the capital.

As always, these figures are simply averages and even at a regional level there can be significant differences from one area and type of property to another.

Rent change over time – ONS:

https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/czcq/mm23

Comments