Blackpool is known for it’s Iconic Tower, illuminations and being home to Pleasure Beach amusement park, but the latest property data shows we need to turn attention to the opportunities for property investment within this UK seaside town.

In 2025, Blackpool house prices increased by an average of £7,000 during 2025, according to newly analysed property market data (ONS). The data shows that more than 2,300 homes were sold across the town, with buyer demand remaining strong despite rising prices. The figures highlight how delaying property decisions is continuing to cost buyers and first-time purchasers thousands.

Using full-year transaction data as well revieiwng the performance of our year at Tiger Sales & Lettings, we can now see how the local market performed, where values increased, and what this meant in real terms for homeowners, tenants, and investors.

Sales Activity in Blackpool During 2025

In 2025, a total of 3,728 properties were brought to market in Blackpool. Of these,2,323, successfully sold, producing an average sold price of £137,000.

This means that homeowners who placed their property on the open market during 2025 had a 68% likelihood of achieving a sale across the Fylde Coast.

By comparison, properties marketed through Tiger Sales & Lettings achieved an 84% success rate, highlighting the impact of accurate pricing, proactive marketing, and committed buyer follow-up in a competitive marketplace.

Property Prices Continue to Rise

The average property price in Blackpool increased from £130,000 in 2024 to

£137,000 in 2025, representing a rise of £7,000 in just twelve months and a 6.1% rise. For many homeowners, this increase occurred without any physical improvements to their property, reflecting wider market movement rather than individual investment.

Despite this growth, Blackpool remains significantly more affordable than surrounding benchmarks:

- North West average: £217,000

- UK national average: £271,000

This affordability continues to attract first-time buyers, home movers, and property investors to the area.

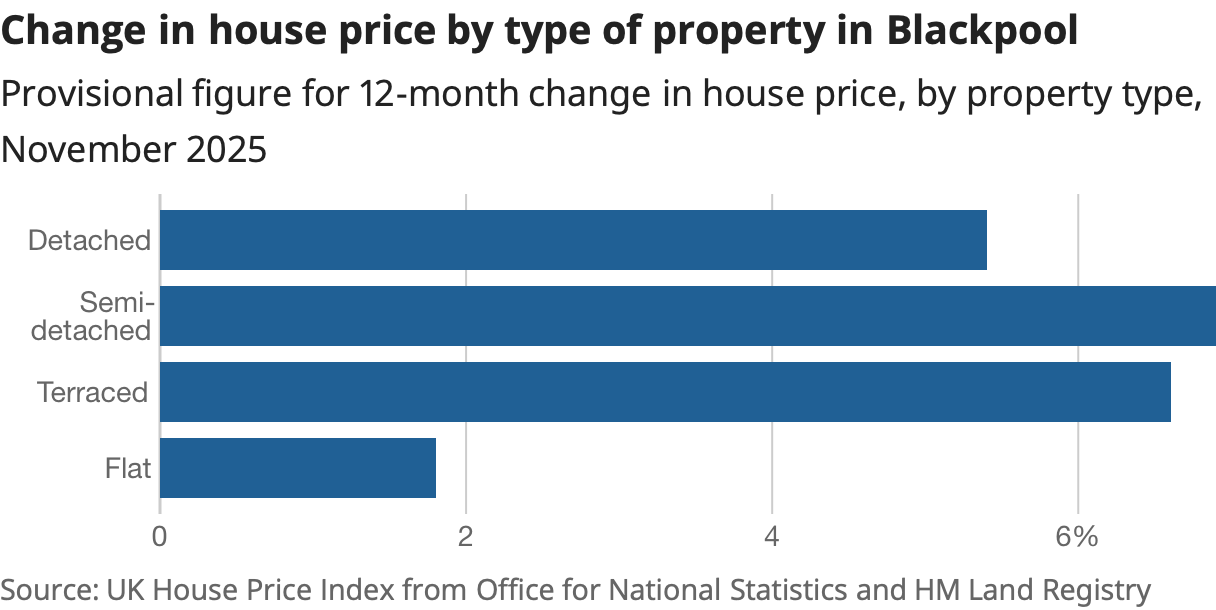

Average Prices by Property Type

A closer look at transaction data shows the following average sold prices across Blackpool in 2025:

- Detached properties: £238,000

- Semi-detached properties: £161,000

- Terraced properties: £120,000

- Flats and maisonettes: £77,000

The graph below shows the provisional figure for 12-month change in house price, by property type:

Source: Office for National Statistics (ONS)

This price range demonstrates that Blackpool remains accessible across multiple buyer profiles, from entry-level purchasers to family home buyers and portfolio investors.

Rental Market Performance in 2025

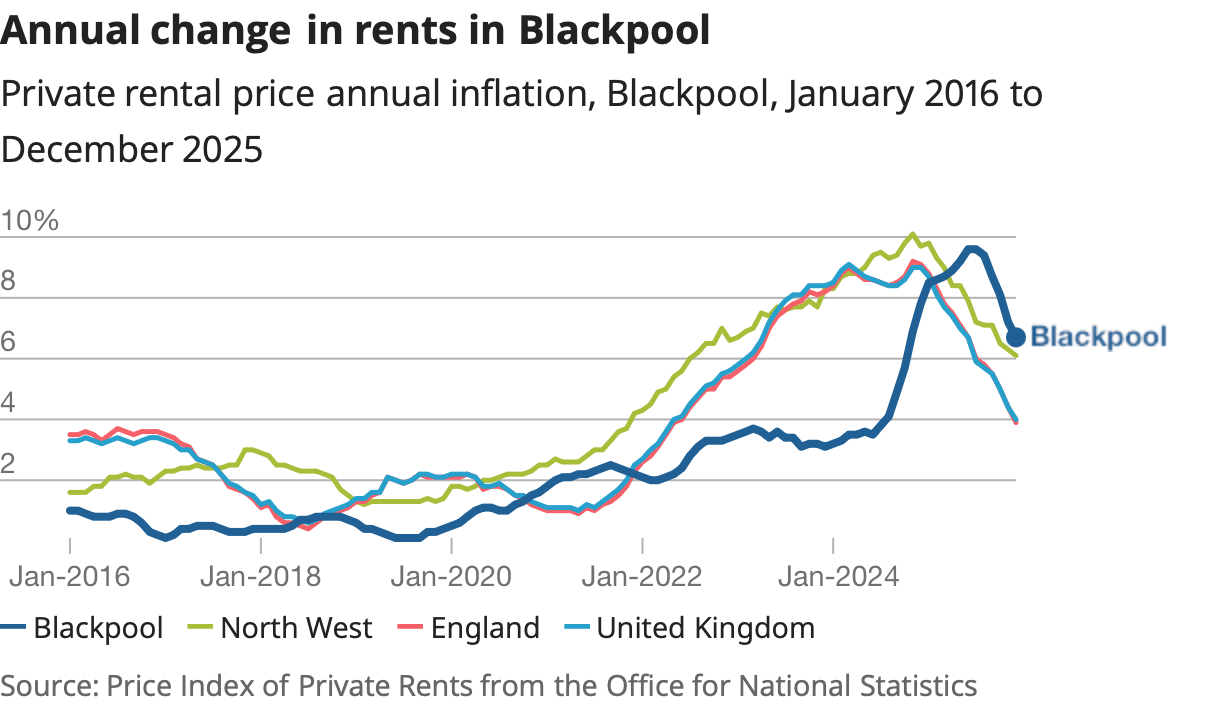

The rental sector also experienced steady upward movement. The average monthly rent in Blackpool increased from £641 in 2024 to £684 in 2025.

The graph below points to the annual change in rents in Blackpool:

Source: Office for National Statistics (ONS)

This change equates to:

• An additional £516 per year in rental income for landlords

• An increased monthly cost of £43 for tenants

Looking at the average rental yield, Blackpool has an average 7.2% gross rental yield as of September 2025. This yield is slightly higher than the ‘average 6.8% average gross yield in the North West’ (Zoopla, September 2025)

Couple this with the £2 billion worth of regenerative investment schemes, and Blackpool promises to be a strong, regenerating town for business investment. Investment schemes such as the Talbot Gateway and the development of ‘Silicon Sands’ are set to bring in thousands of workers and students to the town. And with investment comes increased demand for housing. Alongside the investments to boost Blackpool as an attractive place to start a business, regeneration has also been extended to Housing as the UK government has backed a £90 million housing regeneration scheme to support Blackpool’s levelling up. This investment aims to replace and upgrade poor-quality housing stock with modern, energy-efficient homes.

When reviewing rental performance in this area, and noting that while rent increases have been modest, they reflect continued demand for well-managed rental homes and underline the importance of balancing affordability with sustainable investment returns.

First-Time Buyers and Home Movers

The Cost of Waiting Timing played a critical role for buyers in 2025. First-time buyers paid an average of £128,000, compared with £120,000 in 2024, meaning many paid £8,000 more simply by waiting a year. Similarly, home movers saw average purchase prices rise from £145,000 to £153,000 year-on-year. These figures reinforce a consistent trend: delays in purchasing often result in higher entry costs, even during periods of moderate growth.

Key Takeaway for 2026 and Beyond

The data from 2025 delivers a clear message. For buyers, waiting for “the right time” can increase costs faster than anticipated. For sellers, correct pricing and strong marketing materially improve the likelihood of a successful sale. For landlords and property investors, Blackpool continues to offer sustainable yields supported by consistent tenant demand.

For further insight into local market conditions, property valuations, or investment opportunities across Blackpool and the Fylde Coast, professional advice from experienced local agents remains invaluable.

Comments