This might seem a bit of a dramatic title, but for the first time, I am really worried. With councils under unprecedented financial strain, homelessness figures rising, and intense competition across both the rental and homeownership sectors, the evidence points to a horrendous housing crisis that can no longer be ignored.

Housing Need: The Stark Statistics

According to housing charity Shelter, as of last Christmas, an estimated 354,000 people in England were experiencing homelessness, including over 161,000 children. This represents a 14% year-on-year increase. The breakdown reveals an escalating emergency:

- 326,000 people in temporary accommodation (a 17% annual rise), most of whom are families with children

- 3,900 rough sleepers on any given night (up 27%)

- 16,600 single people in hostels or homeless accommodation

Moreover, over 1.3 million households remain stuck on social housing waiting lists due to the chronic shortage of genuinely affordable homes for rent.

The Local Authority Dilemma: Councils Running on Empty

With local councils’ budgets stretched to the brink, the usual fallback—placing homeless families in hotels or B&Bs—is becoming increasingly unsustainable. Add to this the government’s statutory obligation to provide housing for asylum seekers, and the system is under severe pressure:

- As of December 2023, the UK was supporting over 106,500 asylum seekers, including 45,800 in hotel accommodation

- This figure had only recently dropped from a peak of 56,000 in September 2023

A Strained Private Rented Sector (PRS)

The Private Rented Sector often the only viable alternative for many is also under immense stress. Despite the UK population growing by over 3 million since 2015, the number of privately rented homes has remained stagnant at around 4.5 million.

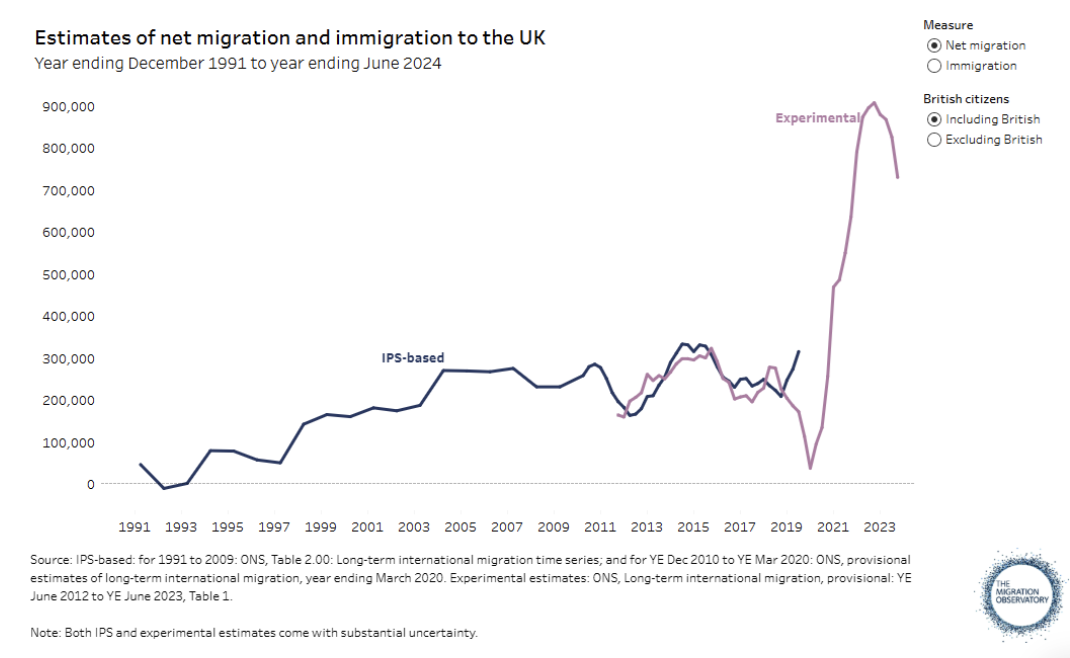

With the pressures of trying to house those on social housing waiting lists, there has been additional pressure to house migrant workers coming to the UK, who typically rent in the PRS before settling down and buying a home. And as the chart shows below, the PRS was under considerable pressure during 23 and 24, hence rents rising, supported by growth in wages.

Currently it’s estimated by Zoopla that there are “12 renters are currently chasing each home for rent. This is down 42% on 2022-24 levels but still higher than pre-pandemic levels” (Rental Market Report, March Zoopla).

And worse still, this level of competition isn’t just at the ‘affordable’ end of the market. I am getting reports that tenants with budgets of £2000+ a month are struggling to find a property to rent, especially if they have children and need to be near schools and family or other supporting services.

So we now have a housing crisis in the rental sector too, although it’s important to be aware that doesn’t exist everywhere across the UK, some more rural areas, especially, don’t have the same level of competition, and it can take a month or more to let a property.

What about the buying and selling market?

As with the rental market, this can vary by area, but there are definitely many areas where we have issues, especially from an affordability perspective.

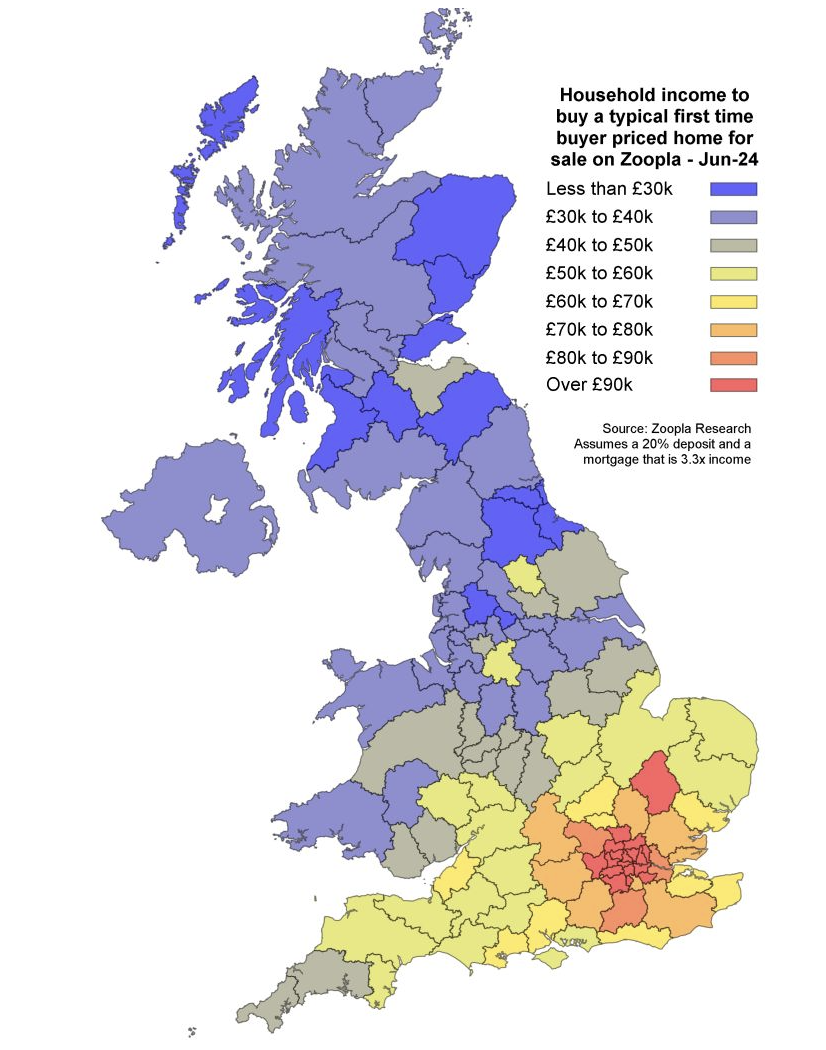

Work by Richard Donnell at Zoopla shows the areas where first-time buyers “could afford to buy a third of homes for sale on Zoopla – with a 20% deposit. The map below shows the percentage of all homes for sale where the mortgage repayments per month would be below the average level of rents in the same area”.

As this map shows, it’s pretty difficult for first time buyers to purchase a property too, although on the other end of the scale, with over 50% of those that own a home, owning outright, in the home ownership market, apart from areas like London, Bristol and other areas in the South and East, there is less of a strain on supply and demand than in the social and PRS tenures.

What do you think? What’s happening in your area?

So for me, I think we are heading to a serious crisis of homes available, and indeed, in some area’s we are already in it, and with the Renters Rights Bill coming in, that could make things a lot worse too if landlords continue to sell off their investments.

Staying informed and engaged with the sector is more important than ever. That’s why events like the National Landlord Investment Show, returning to London on 9th July, are essential. The July Show features vital panel discussions on key issues, including the Renters’ Rights Bill and ‘Rent for Good: an in-depth landlords’ forum focused on social impact and supported letting’.

Register for your free ticket now to stay ahead and stay informed.

By Kate Faulkner OBE, UK Property Analyst, (PropertyChecklists.co.uk)

Published and copyrighted by the National Landlord Investment Show

Established in 2013, the National Landlord Investment Show is the UK’s Number One property investment exhibition, bringing together thousands of landlords, investors, and property professionals throughout the UK. For more information about 2025 shows, exhibition or sponsorship opportunities, visit www.landlordinvestmentshow.co.uk

Comments