Context

To understand today’s student accommodation challenges, it’s helpful to look back at how the market has evolved post-pandemic. A Savills report, drawing on data from the Higher Education Statistics Agency (HESA), highlighted just how sharp the rise in student demand was:

- 2020/21: UK’s full-time student population grew by 8%

- 2021: Record UCAS applications of nearly 750,000

- Over 560,000 acceptances, the second-highest on record

This surge created a significant shortage of beds, with Savills noting: “this is equivalent to around three students per available bed in purpose-built student accommodation”.

This supply/demand tightening supported rents rising sharply, albeit not just in the student sector, but resulting in forcing universities into what Savills described as “extreme action”:

“The University of York and the University of Bristol have housed students in neighbouring towns and cities, the University of Edinburgh has converted common rooms into dorms with bunk beds, and the University of Glasgow has put students in hotels. Meanwhile, students in Durham queued overnight outside lettings agents to secure accommodation.”

Savills further reported that of 44 UK cities with more than 15,000 full-time students:

- 24 recorded rental growth above 7% in September 2022

- London, Manchester, and Salford saw growth of over 15%

- Even cities with falling student numbers, such as Nottingham, Reading and Bath, still saw >7% rent increases due to proportional drops in available rental listings

What’s happening in 2025?

Against this backdrop of high demand and restricted supply, Knight Frank’s latest research suggests that overall, the fundamental challenge of supply versus demand for student accommodation remains:“UK students are struggling to find housing and demand for accommodation is soaring. Supply is failing to keep up, causing rents to rise on average by around 8% this year”

From the Knight Frank report, the June 2025 UCAS deadline confirmed rising student applications:

- Applicant numbers up 1.3% year-on-year

- UK 18-year-olds and overseas students both up 2.2%

- Chinese applications up nearly 10%

- US and Turkey showed growth of 13.9% and 23.6% respectively

- Non-EU applications only rose at “higher tariff universities” (+7.4%)

While new supply is emerging—“London, Nottingham and Leeds are expected to see the largest increases in supply….. but with less than 60,000 beds presently under construction across the UK, the misalignment between demand and supply remains”—the gap between need and availability persists.

Signs of a Turning Point?

However, despite the numbers from the Knight Frank report, HESA data hints that demand growth may be plateauing:

- 2,904,425 students were enrolled in 2023/24 – a 1% fall from the previous year

- First annual decrease in a decade

- New entrants fell 3% overall

- First degree entrants dropped 1%, while taught Master’s numbers dropped 8%

So the conclusion is that the student market remains strong but may have reached its peak. Even so, supply shortages mean demand is still outstripping housing availability in many cities.

Spotlight on Nottingham – Student market demand softening

Nottingham— considered a long-standing buy-to-let hotspot— does appear to be experiencing a shift which goes against the ‘national’ student accommodation picture. A recent in-depth report on the student market by Nottingham City Council shows rising vacancies in Purpose Built Student Accommodation (PBSA):

- 2024/25 PBSA vacancy rate: 11.2%, up from 3.5% the year before

- Cluster flats and studio vacancy rates now equal (11.2%)

Within this report, StuRents data confirms that this fall in demand is across the wider student housing market:

“as of April 2025, leasing of student accommodation for 2025/26 was considerably lower than that of April 2024, which indicates that vacancy rates may be even higher in the next academic year. Some providers may consider lowering rents further due to this softening demand.”

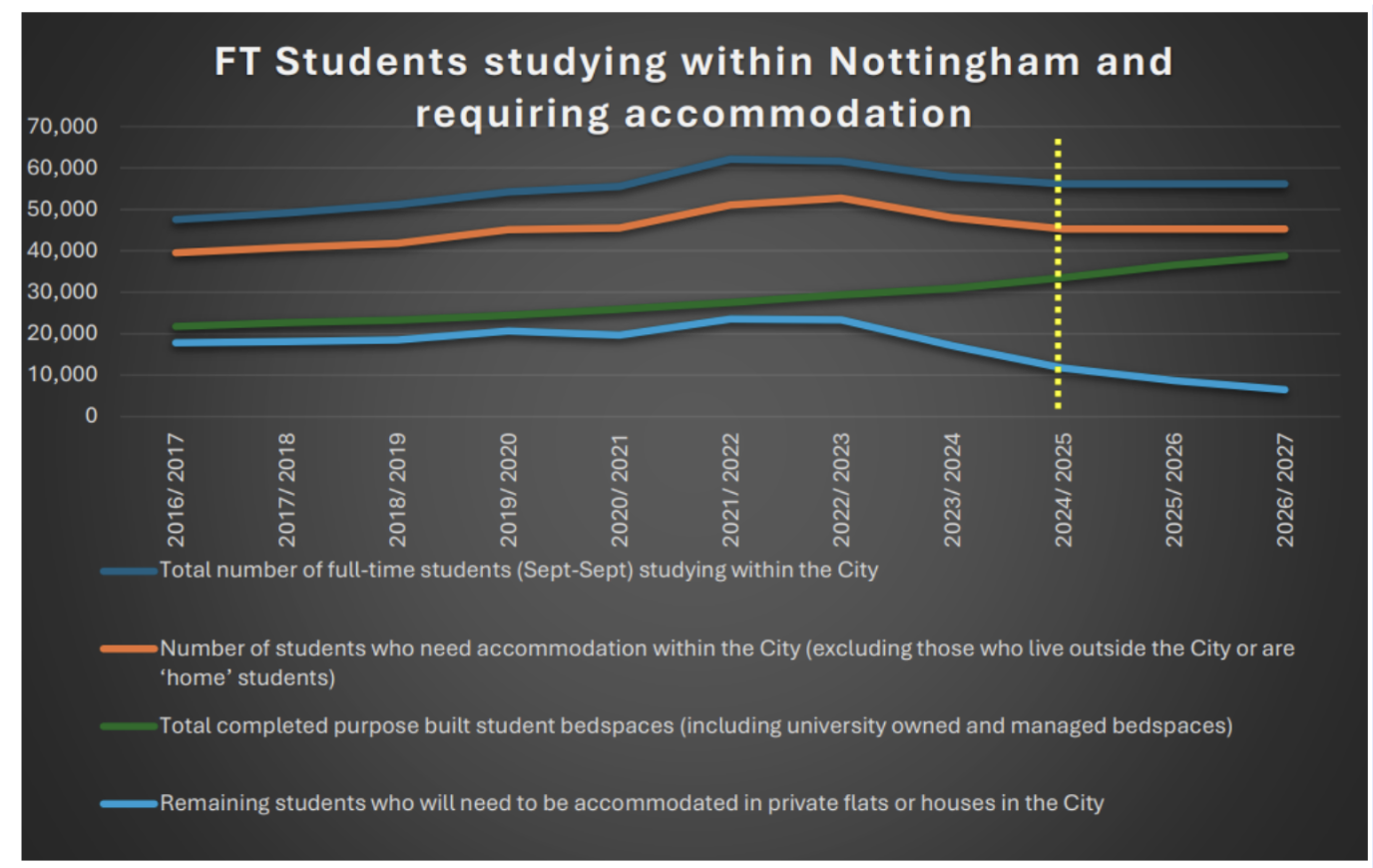

A key reason for the shift in demand versus supply of homes for students is the huge increase in accommodation to date – and forecast of purpose-built student housing. As the chart shows this is expected to lead to a doubling of the number of student beds available since 2016/17 by 2026/7 and it’s clear to see that this is expected to substantially reduce the number of beds needed by private landlords.

Source: City Council Student Accommodation Report, June 2025

The report concluded:

- Full-time student numbers in Nottingham have fallen since their 2020/21 peak

- Net reduction of ~7,450 students needing accommodation since 2022/23

- A growing share of students are East Midlands locals, reducing rental demand

Is PBSA Driving Up Student Rent Costs?

Perhaps the most striking insight from the Nottingham report is: “There are only a few PBSA schemes which are lower in rent than on street HMOs and in these cases, it is only part of those schemes which are lower in price”

This suggests the policy drive to push students into PBSA has had unintended consequences—higher living costs for students.

Supporting this, StuRents data reported in Landlordzone shows:

- Manchester PBSA average rent: £255/week

- Manchester HMO room average rent: £150/week

- PBSA costs 50% more than HMO accommodation

This poses a big question for student living – is it better to have purpose built student accommodation at a higher price, or would they prefer to live a bit more frugally in cheaper accommodation typically provided by individual private landlords?

What do students have to say on the matter? When looking at the latest report from Knight Frank into what students prefer, the report revealed second year+ students are almost as likely to recommend their PRS accommodation to other students as ‘purpose built’. I think this is possibly due to first-year students perhaps leaving home for the first time and using that as a comparison, while second-year-plus students are more used to the ‘reality’ of leaving home!. Yet, it also revealed that when looking at the top prriotiies the quality of accomodation and overall cost

Poll question: Is it better for students to live in PBSA accommodation at a higher cost than rental accommodation provided by private landlords?

Quick poll: What are your thoughts?

Student landlords. Tell us what’s happening in your local area in this quick survey to help us gather further insight into the student property market.

Let’s hear what the experts in the UK Property Market have to say about the 2025 student market:

Fern Tebbutt, Director of Operations (Maternity Cover), from Loc8me, comments:

“The student housing market is as competitive as ever, with everyone looking for the best product at the lowest price. In a recent survey we sent out to our 8,000+ tenants, we asked: What is the most important factor when choosing housing? Over half said cost was their top priority. With students having less money to spend, and parents or guardians less able to support them, affordability has become absolutely key.

The HMO market is now directly competing with PBSA providers, who are cutting rents well below market averages just to fill rooms. For landlords, this makes getting the pricing right from the start of the letting period essential to maximise returns and let properties quickly. We usually base pricing on previous years’ data, looking at how many viewings it took to let a property, as well as location, which came second in our survey.

Looking ahead, the challenges and opportunities are clear. For students, affordability will continue to be the biggest hurdle, with many having to balance budget limits against the desire for well-located, well-maintained, and comfortable accommodation. At the same time, opportunities exist for landlords and operators who offer flexible contracts, inclusive bills, and extra services that make student life easier, something we prioritise at loc8me.

For providers like us, the challenge is staying profitable while competing against PBSA operators willing to slash rents, offer cashback, and throw in incentives. But there’s also opportunity because HMOs can stand out by focusing on community, location, and personalised service, things larger providers often struggle with. Those who use data to set the right rents early, adapt to changing demand, and play to the strengths of smaller-scale accommodation are in the strongest position.

We’re staying positive at loc8me as we head into the 26/27 letting period, and we’re ready to tackle whatever comes our way, including the almighty Renters’ Rights Bill.”

Stay Ahead

Are you a landlord looking to invest in the student property market? It is more important than ever to stay informed. Sign up for your free ticket to one of the upcoming Landlord Investment Shows to network with professional advisors, industry experts and other landlords to discuss strategies.

The Landlord Investment Show is the UK’s number one landlord and property investment exhibition and will be heading to Manchester on 14th October and London on 29th October. Secure your free ticket now for one of our last three landlord shows of the year.

Can’t make it to a show? Join our free online community. Our team of property experts provide exclusive content and guides to help you navigate the latest changes affecting the private rental sector. We publish comprehensive guides and content to help you on your property investment journey, so you can stay informed.

Comments