One of the defining trends in UK property in recent years has been the steady rise of regional cities, with economic hubs seeing strong growth and demonstrating that the country’s housing market is about much more than London.

Whilst Manchester and Birmingham tend to grab the headlines, Bristol is one of the most exciting regional cities to emerge as a buy to let hotspot. This thriving destination has plenty going for it, including a strong economy, a solid track record for price growth and big-city appeal, which helps to ensure steady demand for homes in the private rented sector.

In this feature, we take a look at the appeal of buy to let properties in Bristol for landlords.

Want to connect with property professionals in Bristol? Register for your free ticket to the National Landlord Investment Show in Bristol, held at the Ashton Gate Stadium on the 1st October 2025.

Economic Strength

A strong local economy and consistently high rates of employment are positive signs for buy to let investors. Growing businesses and employment opportunities increase demand for private rental sector property, which can lead to a steady rental income stream and reduce the risk of void periods.

Bristol has clearly demonstrated its strength in terms of economic development and job generation in recent years. Data from the Centre for Cities has shown that Bristol’s economy is one of the fastest-growing in the UK. Bristol’s economy went from 1.3% of UK GDP to 1.5% in 2022, with the number of jobs in the city up by 21% since 2009. It is also home to one of the strongest clusters of high-growth companies outside London, according to Barclays.

The city’s commitment to innovation and infrastructure improvements plays a pivotal role in its ability to attract businesses and residents. Investment projects include the Bristol Airport 2040 Master Plan, which is set to create over 1,000 new jobs and is forecast to generate £3 billion in Gross Value Added (GVA).

Bristol also boasts a well-connected transportation network and its proximity to London boosts its appeal as a location for businesses and professionals alike. Employment opportunities across a wide range of industries contribute to a dynamic job market, drawing in workers who, in turn, drive demand for housing.

For those considering buy to let properties Bristol, the city’s solid economic foundation supports its reputation as a vibrant and desirable place to live and invest, keeping demand for housing consistently high in both the sales and rental markets.

Bristol Housing Prices

If long-term capital growth is one of your top property investment goals, you’ll want to know more about recent house price trends in the destination you’re considering.

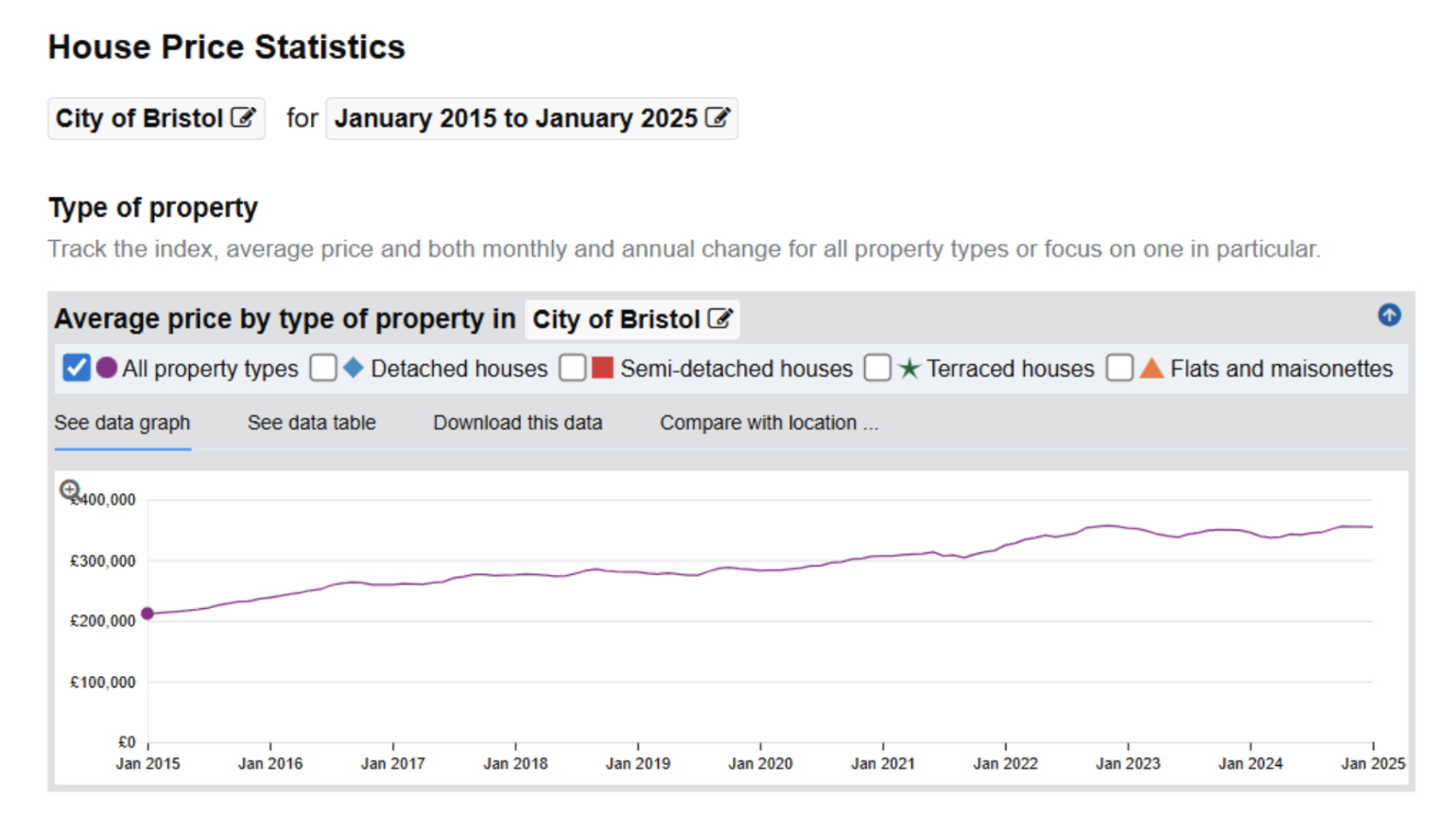

Data from Land Registry has shown that average property values in Bristol have increased from £210,475 in January 2015 to £354,699 in January 2025, marking a significant increase over a 10-year period.

More recent data has shown that Bristol housing prices continue to report steady growth, with the Office for National Statistics reporting a 2.7% increase in May 2025 compared to May 2024.

Bristol also outperformed the broader South West region, where growth was recorded at 1.9% during the same period. First-time buyers are particularly impacted by rising values, with the average price for this group rising from £305,000 in May 2024 to £313,000 in May 2025 by the same 2.7% increase.

Looking to the future, Savills forecasts a stable 20.4% house price growth for the South West region over the next five years, giving investors strong reasons to feel positive about capital gains potential.

Bristol Rental Market Overview

For those considering investing in a buy to let property in Bristol, one of the main considerations will be the demand from tenants, since this factor underpins rental yields and growth potential.

Interestingly, in 2024, ITV reported that Bristol saw the second biggest increase in private rents in the UK, with the average cost of renting in the city increasing by 62.9% between August 2015 and August 2019. This trend reflects the high demand for rental property among tenants across the city.

Today, the rental market in Bristol has shown varied trends over the past year, with private rents experiencing a modest decline. As of June 2025, the average monthly rent was £1,753, marking a 1.1% drop from £1,773 in June 2024, which demonstrates the city’s nuanced rental dynamics.

Despite this slight reduction, Bristol remains a sought-after location and, as with any rental market, will see fluctuations throughout the year.

According to the ONS, rental prices in the city vary widely based on property size, with one-bedroom units averaging £1,138 according to June 2025 figures, while two-bedroom properties are typically around £1,435. Larger homes with three bedrooms command approximately £1,629, and properties with four or more bedrooms average £2,385 per month.

If you’re considering Bristol for your next property investment, why not speak to local market experts at the National Landlord Investment Show? Book your free ticket today for the exhibition held at Ashton Gate Stadium on the 1st October 2025.

Bristol Rental Demographics

There are certainly encouraging signs that buy to let properties Bristol are ones to watch in terms of house price and rental growth; however, it’s important to understand what is driving this growth and whether the fundamentals of this market will present a long-term opportunity.

A rising population is often a key indicator of a buy to let hotspot, and, according to the 2021 Census, Bristol’s population increased by 10.3%, from around 428,200 in 2011 to approximately 472,500 in 2021. The average age of a person living in Bristol is 34 years, with the number of residents aged 25 to 34 years increasing by 11,100 (14.4%) between the last two censuses, meaning there is a large pool of the population who fall into the typical age profile of a renter.

Bristol’s rental market benefits from the city’s growing and diverse population, creating a consistent demand for housing. The city attracts a wide range of renters, including professionals drawn by its thriving job market, families seeking access to quality schools and amenities, and students attending its two major universities. This mix ensures that rental properties cater to varied preferences, from compact apartments in the city centre to larger homes in suburban neighbourhoods.

The influx of young professionals is particularly notable, with many seeking housing close to the city’s business hubs and vibrant cultural scene. These tenants often prioritise modern features and convenient access to transport links. Families, on the other hand, tend to look for properties with additional space, proximity to green areas, and schools with strong reputations.

The city’s student population has also had a significant impact on rental demand across the private sector. Bristol’s universities, the University of Bristol and the University of the West of England (UWE), significantly influence the city’s rental market, creating strong demand for student housing.

With a combined student population exceeding 68,000, these institutions attract both domestic and international students, many of whom require off-campus accommodations. What’s more, Bristol Live has reported that the city needs an additional 20,000 student rooms to accommodate the rising number of students in the city.

This shortage of purpose-built student housing presents opportunities for landlords who can provide suitable properties near campus or with convenient transportation links.

With a variety of property types needed to cater to the city’s buoyant rental market, there are plenty of opportunities available for landlords considering buy to let properties Bristol.

Outlook for Buy to Let Properties Bristol

Bristol’s buy to let market offers a promising environment for property investors. The city’s diverse rental demographics, ranging from students to families and professionals, provide opportunities to target various tenant groups based on property type and location.

Areas close to universities, business hubs, and well-connected transport links continue to perform strongly, reflecting the preferences of many renters. Additionally, ongoing urban developments and private regeneration schemes are reshaping the market, presenting new possibilities for long-term investment strategies.

National Landlord Investment Show Bristol

Register for your free ticket to the National Landlord Investment Show in Bristol, held at the Ashton Gate Stadium on the 1st October 2025. You’ll have the opportunity to connect with local property market experts and to speak to landlords already operating in the market to determine whether buy to let properties in Bristol are the right choice for your investment portfolio.

Comments