Published by the National Landlord Investment Show

The Bank of England (BoE) announced on 6th November that it is maintaining its Bank Rate at 4%, following a 5–4 split decision by the Monetary Policy Committee (MPC). Four members voted to reduce the rate by 0.25 percentage points to 3.75%.

This marks the second consecutive meeting in which the MPC has chosen to hold rates, a sign of caution in an era of uncertainty. Despite sluggish UK economic growth, the decision reflects the Bank’s continuing concern about inflation, which remains around 3.8% in the 12 months to August, nearly twice the Bank’s 2% target.

The hold suggests the MPC is adopting a cautious policy stance, particularly ahead of the Autumn Budget, where further inflation-dampening fiscal measures are expected to be announced

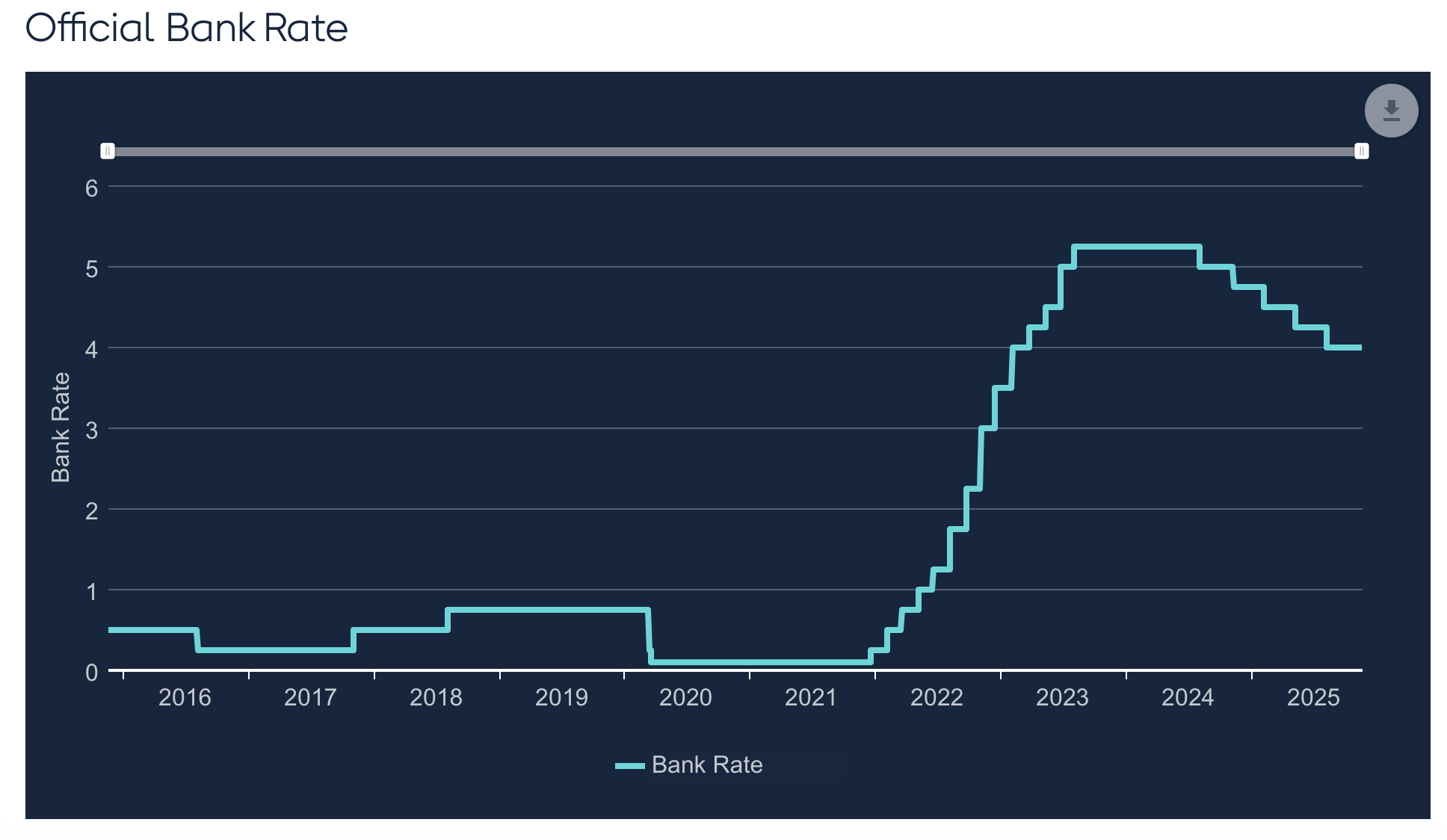

A Yo-Yoing history of base rates

Looking at the recent history of interest rates, the UK has seen a period of dramatic highs and lows, but this latest decision signals a potential policy pause, risk adversity and a move toward stability.

In the wake of the pandemic, the UK entered an era of ultra-low interest rates. The Bank of England’s base rate was cut to just 0.1% in March 2020, the lowest level in over three centuries, as policymakers sought to cushion the economy from lockdowns and uncertainty.

From late 2021 onwards, the tightening cycle began in response to surging inflation and global supply chain disruptions. By August 2022, before Liz Truss became Prime Minister, the base rate had already risen to 1.75%.

Although Truss’s short-lived premiership is often blamed for the sharp acceleration in rate hikes, it’s important to note that the trend was already underway. Her government’s “mini-budget” merely triggered a steeper climb, pushing the rate up to a peak of 5.25% in August 2023.

A good way to visualise the journey of bank rates over recent years, from record lows to rapid hikes, and now a policy pause, is the Bank of England’s official Bank Rate chart below.

Source: Official Bank Rate History – Bank of England database https://www.bankofengland.co.uk/boeapps/database/Bank-Rate.asp

Why have the MPC chose to hold and not cut?

The MPC’s decision comes from the need to primarily monitor inflation rates, but several other important factors explain why it has chosen to hold the Bank Rate rather than cut it at this stage:

- Inflation remains elevated: At 3.8%, it is nearly double the Bank of England’s 2% target. The hold signals the Bank’s intention to maintain some pressure on borrowing and spending to keep inflation under control.

- Economic growth is weak: The UK’s real GDP grew by only 0.3% in Q2 2025 compared with Q1, indicating flat growth. At the same time, the labour market is softening. Despite this, monetary policy remains restrictive, and the MPC is cautious about loosening too soon.

- Fiscal uncertainty: With the upcoming Autumn Budget expected to outline further government spending and tax measures, the MPC is taking a cautious approach, waiting to see how these policies may influence inflation and growth.

What does this mean for landlords?

For landlords and property investors, particularly those with buy-to-let mortgages, this decision carries a mix of stability and uncertainty. Should you act now to buy a property while most markets are fairly flat and some have property prices which are lower than they were three years ago (2022), or wait and hope that they can lock in a cheaper mortgage, but risk competition for properties and prices will rise?

What does this rate hold mean for landlords in the run-up to Christmas?

- Higher borrowing costs persist: With no rate cut, variable and tracker mortgages remain expensive. Landlords will continue facing elevated monthly repayments.

- Tenant affordability under pressure: Some landlords may feel forced to pass higher costs onto tenants, though rising rents risk outpacing wages. Recent analysis by The Times found that mortgage and rental costs rose sharply when rates peaked.

- Investment decisions delayed: While the hold offers some stability, higher financing costs than expected in 2026 may deter landlords from expanding or purchasing new properties.

- Yields under strain: As borrowing costs stay high and rent growth levels off, rental yields may narrow, squeezing profitability.

- Remortgaging decisions critical: Those nearing the end of fixed deals should carefully review options now. Only a qualified mortgage broker or advisor can explain what’s right for an individual’s personal circumstances, so now is the perfect time to give them a call.

Concluding thoughts

The MPC’s decision to hold the Bank Rate at 4% provides short-term stability but offers little relief for landlords still facing high financing costs. The move signals that the era of rapid rate cuts is on pause and is likely to remain so until inflation falls further. For now, it’s very much a “wait and see” situation, particularly with the upcoming Autumn Budget expected to influence both inflation and the broader economic outlook.

With the next MPC meeting on 18 December, landlords should review their portfolios and mortgage arrangements now. Waiting for lower rates could save on interest, but it also risks missing property opportunities available today.

If rates remain unchanged in December, the next chance for movement won’t come until February 2026.

We asked our mortgage broker partners what landlords with mortgages should do over the coming months.

Jeni Browne, Business Development Director, Senior Mortgage Broker and Landlord from MFB, commented:

“We have recently seen a slight reduction in fixed rates, as the markets become more confident in a December Base Rate reduction. However, the Autumn Statement could send rates up, depending on what Chancellor Reeves comes up with (cast your minds back to the mini-budget if you want an illustration of how things can go!).

Mortgage offers are valid for between 3 and 6 months, so I advise that anyone who wants or needs a mortgage before June 2026 applies for a deal now. Helpfully, most lenders allow you to switch to a new, lower rate from their product range before completion, should they release one, and your rate is usually protected if mortgage rates rise.”

Simon Howitt, Senior Partner from Acuity Professional Group, commented:

“The Bank of England’s decision to hold the base rate at 4% signals that the era of rapid rate changes are ending. For landlords, this creates a short window of stability—important for anyone with mortgages approaching renewal.

What This Means for Buy-to-Let Mortgages:

- Rates now stabilising rather than falling. Expect little downward movement until early 2026.

- Lenders reopening product ranges: more 5-year fixes, HMO/MUFB, and specialist landlord options.

- Better product stability as lenders gain confidence to keep deals on the shelf.

Impact on the Property Market:

- Flat prices create a short-term buying opportunity.

- Buyer confidence is slowly returning.

- Rental growth stabilising, so landlords must optimise cash flow.

- Yields being squeezed means strategic financing is now more important.

Broker Perspective – What Landlords Must Do Now:

- Start remortgage planning 4–6 months early. Lock a product now; switch later if pricing improves

- Fix or float based on strategy:– 5-year fixes for certainty/– 2-year fixes for flexibility ahead of expected 2026 cuts.

- Act before December. If the MPC moves unexpectedly, lender pricing changes within hours.

Use this moment of stability to act. Review your financing strategy, engage brokers early, and prepare for a more favourable rate environment in 2026.”

Ryan Etchells, Chief Commercial Officer at specialist property lender Together, commented:

“The Bank of England has erred on the side of caution, putting any good news for UK borrowers, investors and developers on ice for the time being.

“Despite a positive inflation reading in the last report, the Bank knows that the dangers of volatility could rear their ugly head should rates be cut too early. While the MPC’s 2% inflation target is within reach in the coming months, this comes at the expense of the wider economy, which is in dire need of growth and will have to contend with continued elevated borrowing costs. The Government’s own target of 1.5 million new homes by the end of parliament stands to be embarrassingly undershot should the current lack of financial incentives for private developers continue.

Hopes and expectations now turn to the Budget later this month, with the industry poised on a knife-edge. Potential changes to property tax, including a rumoured replacement of the stamp duty regime with a national property tax, may provide relief to the property market, or add further financial headaches to the bonfire.”

In today’s fast-changing property market landscape, staying informed and connected is key. Make sure to join important events like the 2026 National Landlord Investment Shows with multiple dates and locations now released here.

And for ongoing insights between events, join the free LIS Landlord Community Hub for the latest budget updates, reports, and training resources on the Renters’ Rights Act, Making Tax Digital, and so much more!

Useful sources

- Monetary Policy Summary – November: https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2025/november-2025

- Monetary Policy Committee dates for 2025 and 2026: https://www.bankofengland.co.uk/monetary-policy/upcoming-mpc-dates

Comments